BREXIT and its impact on Africa and the real estate industry

Systems, institutions, regulations and ideologies make it seem like the world is gearing towards a uniform front but as we all can see it is not so. UK, a leader in convivial trade policies in the world, voted to exit the European Union (EU) in a controversial referendum.

This long awaited decision by the United Kingdom came as a result of the promise of Prime Minister David Cameron to hold a referendum during office.

The EU was seen as a threat to the British sovereignty in that more power was shifted from individual member states to a central bureaucracy in Brussels allowing the EU governing body to set policies concerning agriculture, copyright and patent laws competition among others and such laws or policies overrides national laws, and even in the case of accountability the EU executive arm- European commission is not directly accountable to the voters of Britain.

Also, UK felt they were being strangled with burdensome regulations set by EU-“EU rules sound simply ludicrous, like the rule that one cannot recycle a teabag, or that children under eight cannot blow up balloons, or the limits on the power of vacuum cleaners. Sometimes they can be truly infuriating”-Said one critic, Boris Johnson.

There are nearly 130 Conservative MPs who were in favor of UK leaving the EU," economist Andrew Lilico stated in an interview "If you went back 10 years, you would have struggled to find more than twenty who even in private would have supported leaving the EU." So we ask what changed their minds, the EU was a good idea but the Euro was a disaster, following the poor performance of the Euro causing an economic recession in 2008 causing high rate of unemployment in Spain as well as Greece, and this countries as at now are still trying to recover from the impact of such an economic blow, luckily UK chose not to join the common currency saving its economy from any disaster. But for the Eurozone to work properly there is a need for a deeper fiscal and political integration which UK would have also contributed as a member.

Another troubling issue EU brought was that it allowed too many immigrants. EU rules require the UK to admit all EU citizens who wants to move to Britain, whether or not they have good job prospects or English skills. In recent years, hundreds of thousands of Eastern Europeans have come to Britain to do jobs, and this has undercut the native working population. The UK absorbed 333,000 new people, on net, in 2015. That’s a significant number for a country Britain’s size. Thus UK argues that they could have a more rational immigration system outside the EU, In that, the UK should be focused on admitting immigrants who will bring valuable skills to the country and integrate well into British culture. Making reference to the point-based immigration system adopted by Canada and Australia where potential migrants are awarded points based on factors like their language and job skills, education, and age. This would allow the UK to admit more doctors and engineers who speak fluent English, and fewer unskilled laborers with limited English skills.

Britain accounts for just 3.9% of the world’s output; it is not big enough to make the global economic weather in the way America or China can. So one may ask, what is the impact of BREXIT on Africa?

Globalization has led to the integration of markets and countries thus investors and economist now see the world as a larger market, hence anything happening on the international market will adversely affect the local market as well. Looking at the international arena, some people argue that a recession in Britain nevertheless seems likely and Britain is big enough for a recession there to have a meaningful effect on Europe’s economy.

Britain’s economy looms large in Europe, where it is a reliable consumer in an otherwise high-saving continent. And any disruption to European growth is particularly unwelcome now. Spending on big-ticket items is likely to slump. The pound which has started collapsing will drive up inflation, crimping real incomes. Some jobs will go. Hours worked and wage growth will fall and whatever the reduction in Britain’s GDP growth, Europe’s economy will suffer a drop of about half as much.

Corporate investment will be hurt by uncertainty about future access to both the single market and to other places where Britain has piggybacked on trade deals negotiated by the EU. In unsettled times, businesses defer whatever spending they can. Even if some investors have short horizons, tumbling stock markets reflect some long-term worries. If Britain, long a champion of free trade, can vote to revoke a regional trade deal, how much faith can businesses worldwide put in other international economic agreements.

With all this happening on the international front, the African economy is faced with uncertainty even though The UK’s minister for Africa and advocate for leaving, James Duddridge, has promised that relations with the continent would only improve without the burden of the EU, but Africa’s largest economies such as South Africa and Nigeria are still likely to suffer.

South Africa’s already battered economy may be the worst affected by Britain’s exit. In recent days the worst performing currency after the British pound is the rand which has fallen more than 7%, its steepest single-day decline since the 2008 financial crisis. Not just, major South African companies dual-listed in London and Johannesburg are being hammered. South Africa’s close financial ties to the UK could be a problem—British banks’ claims on South African entities account for 178% of South Africa’s foreign currency reserves, according to analysts from UniCredit.

Economists also worry that trade between Africa’s most industrialized economy and the UK will suffer. As UK is the fourth largest destination for exports from the country, according to data from Bloomberg.

Britain’s exit from the EU could not have come at a better time for Nigeria, Africa’s largest economy. At a time when the government is trying to fix an economy on the brink of a recession by removing strict currency controls and also liberalizing oil prices, the immediate effect of Brexit will test the nerves of Nigeria’s economic managers as global markets plummet. Bilateral trade between Nigeria and the UK, currently valued at £6 billion (about $8.3 billion) and projected to reach £20 billion by 2020, will be disrupted as trade agreements made under the auspices of the EU have to be renegotiated.

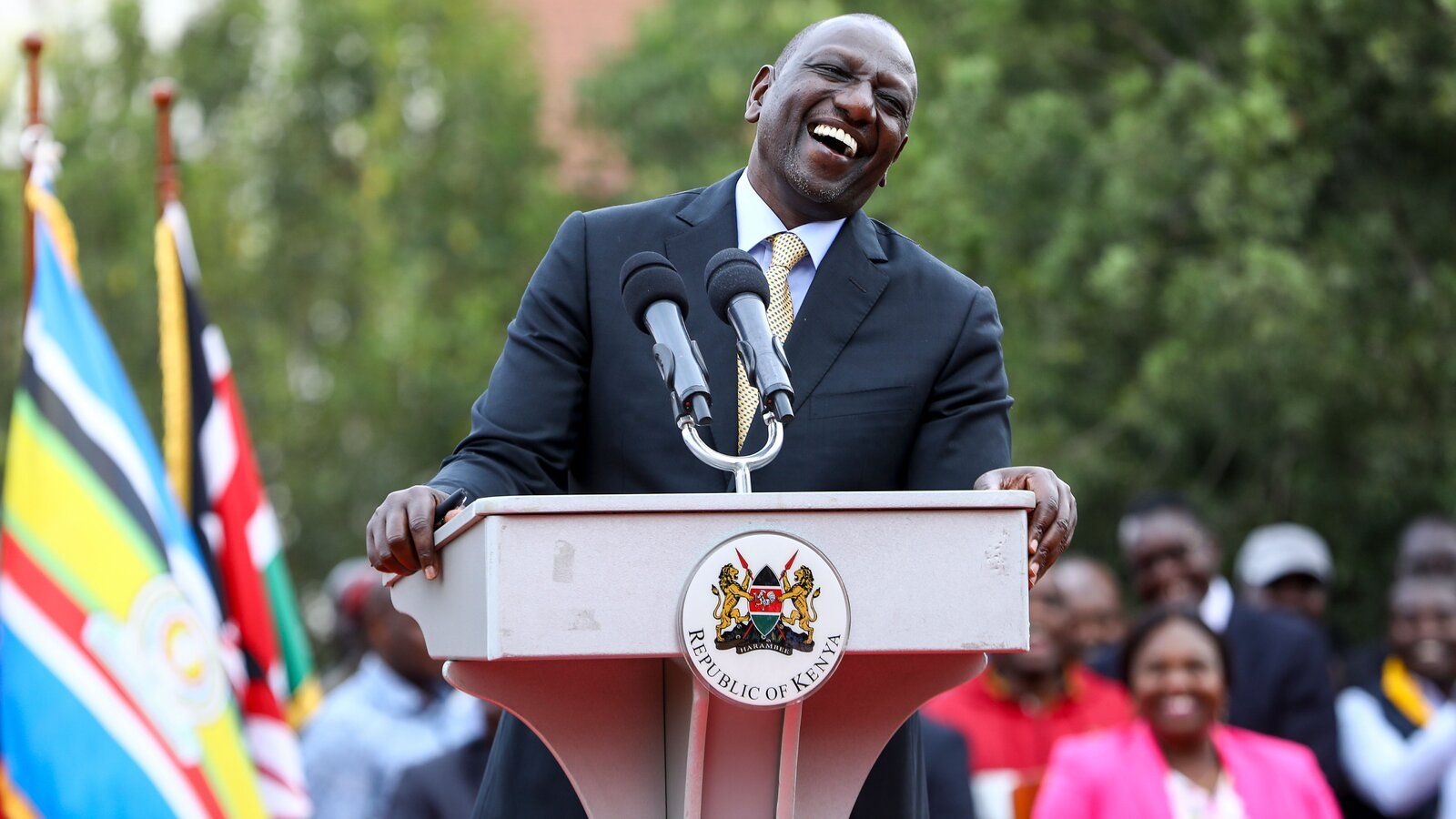

And not just South Africa or Nigeria but most African countries will suffer, For instance, the Kenya Flowers Association is rightly worried. Although here it appears that most of the worrying has got to do with uncertainty around whether Kenya and the UK will have to negotiate new trade deals that might be different from the ones already negotiated with the EU. More about this later. Most business in the African continent are faced with uncertainty

Real estate and investors who come from UK and others who might have been awarded projects by the EU are likely to face some challenges when it comes to their operations with this whole new level of uncertainty for UK and an immediate restructuring of EU in order to curb the impact of BREXIT. So as it stands most countries, economies, investors, businesses and people are uncertain of the impact Brexit carries, all they do is hope and anticipate for a positive impact in due cause.

PE local

Michael Essah Baidoo

Comments System WIDGET PACK

.jpg)