Africa Home Building News 01/09/23

Hello and and welcome to African Home Building News

Our top stories

Ghana's Construction Sector Report 2022 indicates the sector is an untapped market for affordable housing.

Dangote Cement has reported a robust pan-African performance

In International News

The Turkish real estate landscape has proven to be a lucrative arena for capital growth

Ghana's Construction Sector Report 2022 indicates the sector is largely an untapped market for affordable housing..

Ghana's Construction Sector Report 2022 indicates the sector is largely an untapped market for affordable housing..

It said the construction boom in Ghana can be attributed to various factors, but one of the standout catalysts is the government's unwavering commitment to infrastructure development. .

Adding that the strategic fiscal plans set forth by the government have provided a solid foundation for the sector's expansion.

It said Public-Private Partnership (PPP) initiatives, private investments, and Foreign Direct Investment (FDI) in key sectors such as mining, oil, and gas have been instrumental in shaping the construction landscape.

Ghana's proactive participation in this initiative has positioned the nation as a hub for regional trade, offering promising opportunities for the construction sector.

A standout feature of Ghana's construction landscape is the largely untapped market for affordable housing, commercial buildings, and infrastructure development..

This presents an alluring prospect for both local and international investors. With a rapidly urbanizing population and a burgeoning middle class, the demand for residential and commercial structures continues to surge.

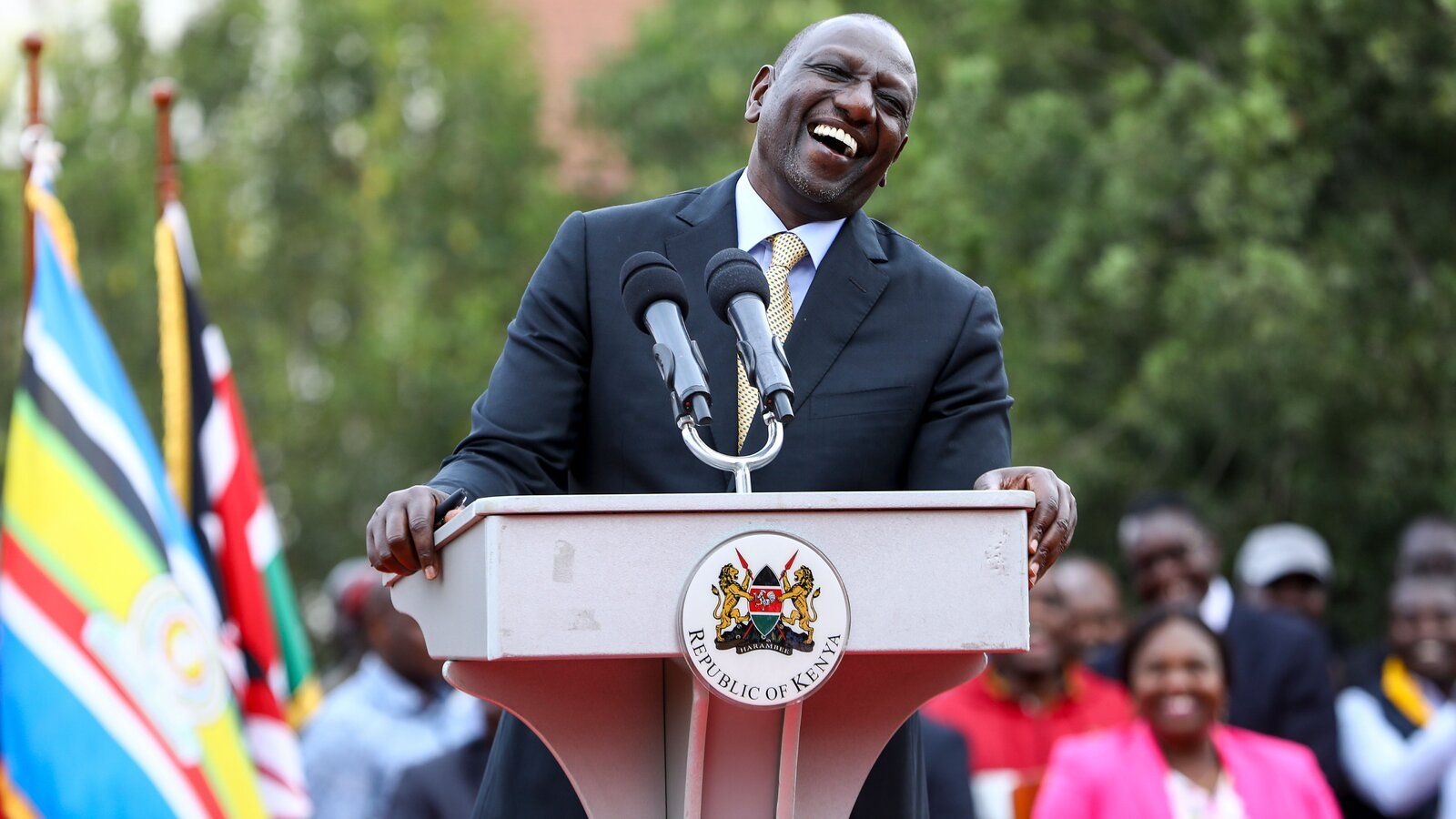

Dangote Cement has reported a robust pan-African performance

Dangote Cement has reported a robust pan-African performance for the half year ended June 30, 2023, with sales volume hitting 5.4 metric tonnes.

The pan-African region includes all the cement plant’s operations outside Nigeria.The total sales volume for the Group within the period was 13.4 metric tonnes.

According to the company’s six months’ unaudited results, sales volume for pan-African operation was up 11.6 percent compared to 4.9 metric tonnes in the first half of 2022.

The total pan-African volume accounts for 40.4 percent of Group volumes in the half year. The pan-African operations performance is attributable to robust demand, particularly from Ethiopia, Senegal, Zambia, and Congo.

Hence pan-African revenues grew by 81.8 percent.

Still in Nigeria

Cribstock, a Nigerian startup focused on real estate investment, is revolutionizing the process of becoming a landlord by enabling users to purchase shares of properties.

These property shares generate monthly rental income from tenants in Lagos.

Founded in 2021, Cribstock empowers users to own fractions of real estate properties and earn a portion of the rental income they generate.

Harold Nno, the CEO, describes it as a platform that allows micro-investors to collectively invest in real estate and benefit from its returns.

The startup has gained remarkable traction. With 17,000 potential retail investors already registered on its platform, Cribstock currently has four properties listed.

The goal is to increase this count to 12 properties by February of the following year, thereby providing more investment options to its enthusiastic user base.

Presently, it is in the midst of securing a pre-seed funding round of US$400,000, which is expected to sustain its operations for the next 12 months. While its current operations are limited to Nigeria.

Cribstock has ambitions to expand into the US market in due course.

In other news

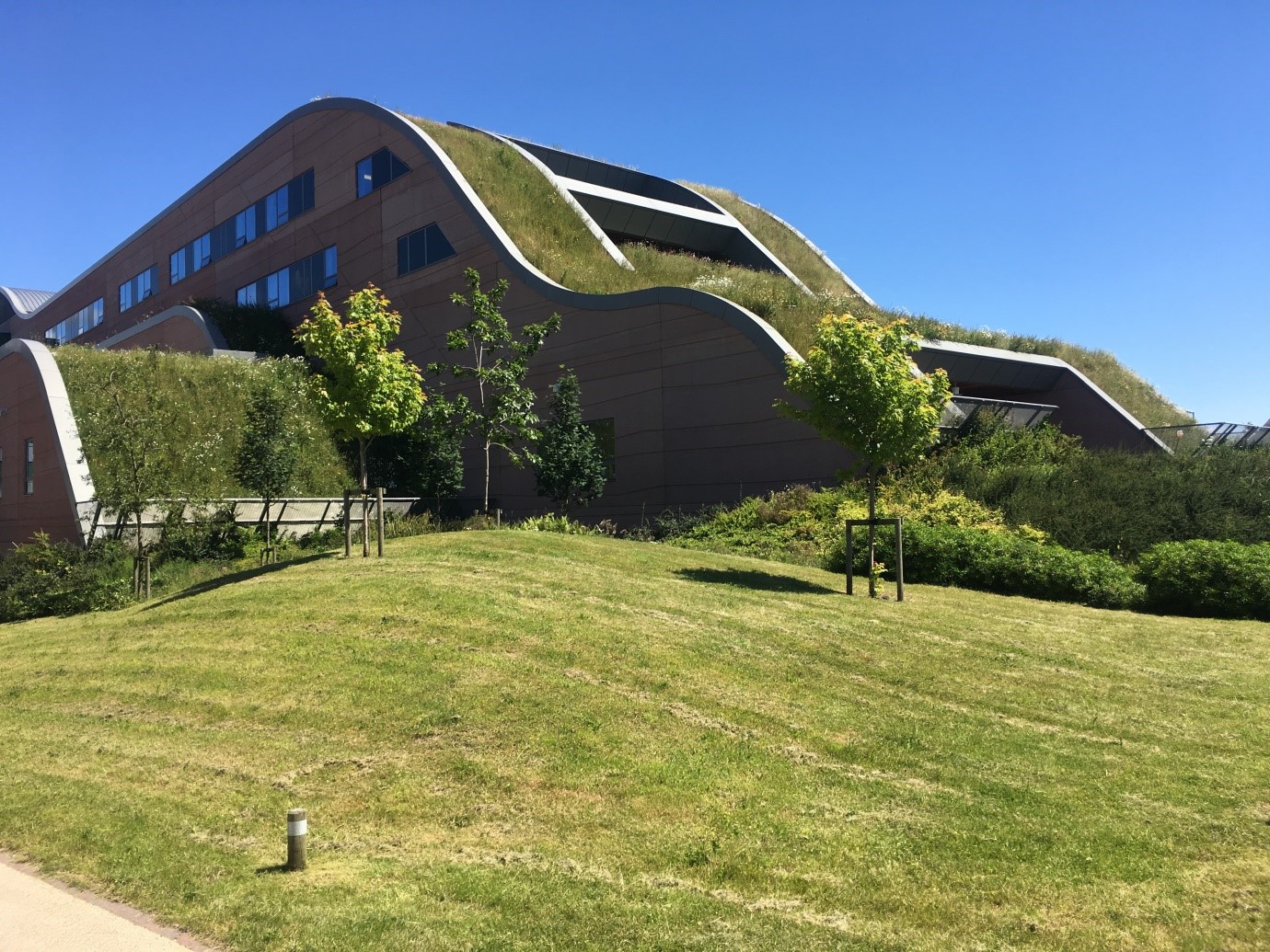

The Turkish real estate landscape has proven to be a lucrative arena for capital growth, with property investors experiencing a twofold increase in their investments within a mere span of two years.

Astute investors who entered the market in March 2021 by acquiring residential properties witnessed their holdings escalate in value twofold.

This meteoric rise in property valuation has been especially pronounced during 2022, as the average house prices across Turkey surged by an impressive 75% when measured in US dollar terms.

The distinctive approach of the Turkish central bank, characterized by an unorthodox monetary policy, became a pivotal factor in this paradigm shift.

Source : Africa Home Building News - Joycelyn Marigold & Diana Okyerebea

REGISTER TO EXHIBIT

.jpg)