The rise of internet veg box schemes in sub-Saharan Africa

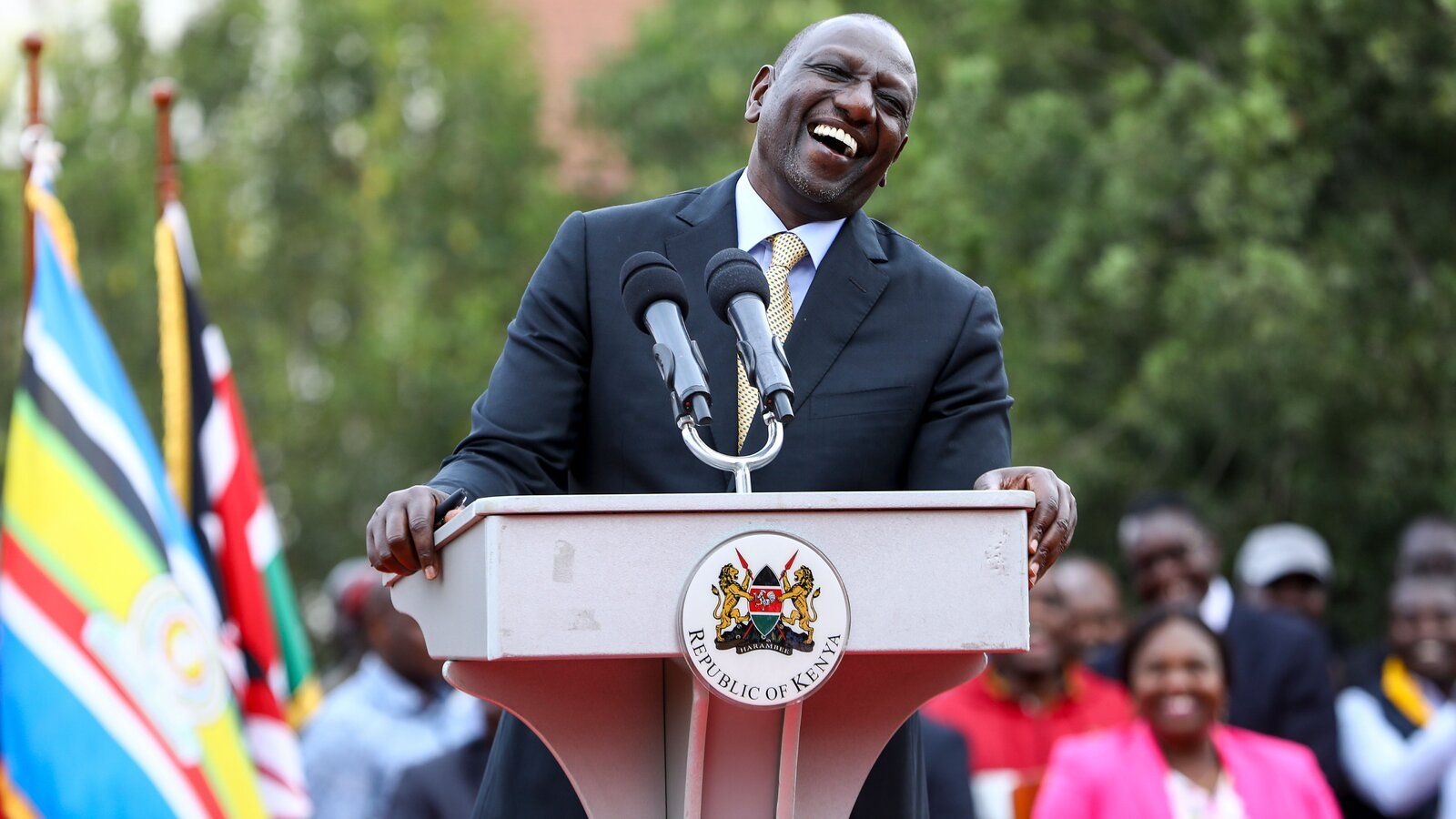

Online grocery startups in Kenya, Rwanda and Gambia help farmers cut out the middleman, but challenges such as low internet access may hinder profitability

Growing up on a farm in central Kenya, Winston Wachanga witnessed the piles of fruit and vegetables that perished after never making it to a market.

Later with a tomato farm of his own, he experienced the same struggle of farmers across the country trying to find a buyer. “We have so much produce but accessing customers is difficult. We don’t have capacity to get produce to market and we end up being exploited. It becomes frustrating,” he says.

To solve this gap, Wachanga set up online delivery company Kitchen Soko. In less than a year he has built up a network of 80 local farmers in Kenya whose produce is delivered in a box straight to the customer’s front door. Customers can find out exactly which farm the produce has come from.

Wachanga is one of the tech entrepreneurs tapping into Africa’s middle class as well as the continent’s improving access to internet. In 2013 McKinsey estimated that by 2025 e-commerce could account for 10% of retail sales in Africa’s largest economies.

Kitchen Soko says it now supplies 500 boxes a week. Expats make up about one quarter of Kitchen Soko’s clients, says Wachanga, but the rest are Kenyans. “Middle-class Kenyans living busy lives in the city, like those in other growing economies, value their time,” he says. “That’s why there is a lot of e-commerce.”

Reports about dangerous toxins found in food sold in Nairobi have led to a surge in demand, says Wachanga. Recent tests on a sample of food bought in markets and supermarkets in the city found chips cooked in transformer oil, fruit containing traces of calcium carbide – usually used in welding – and kale containing toxic levels of lead. “Big suppliers don’t care where the food comes from. We are letting people know the source,” says Wachanga. “All our producers have to go through our food principles. They have to strive to produce food as organically as they can.”

In Gambia, IT entrepreneur Modou Njie also saw an opportunity to buy food directly from local food producers and cut out the middleman, launching Farm Fresh last August. Its website offers more than 100 products, while farmers receive specific orders and a guarantee the produce will be bought from them.

Farm Fresh has seen steady demand in its first year and is soon launching in Sierra Leone with plans to extend to Senegal and Ghana.

Providing a direct link from farm to fork isn’t always straight forward, however. This is true of Rwanda whose nickname “the land of a thousand hills” hints at the logistical struggle.

Civil engineering graduate Gael Murara recently introduced online grocery deliveries to Kigali, Rwanda’s capital, with his startup GroceWheels. While his aim is to buy directly from farmers, he needs to build up enough demand to make that practical, and in the meantime he buys from wholesalers.

Part of this demand driving process will be about familiarising people with the concept of home delivered groceries. “E-commerce is very new. I have a lot of people asking where we work from, I say we are just online, we don’t have a shop. It’s the fact they don’t see the person they are buying from,” Murara says.

For the farmers, these companies say they offer better profits and spark competitive prices. Wachanga says that middlemen in traditional supply chains in Kenya are now having to compete with the rates that Kitchen Soko offers its farmers, and so have to give farmers better deals.

Better deals for farmers could incentivise people to remain in or enter agriculture, a sector that struggles with a reputation for being a lot of hard work for little pay. “If you say you’re a farmer they will just laugh at you. It isn’t highly regarded,” says Njie. “A lot of people are not aware that agriculture is a lucrative market.”

In Kigali, Murara hopes to show young people that agriculture “is not just getting up at 5am to tend to crops ... People don’t really realise the market that is there. There are a lot of exciting things that can reduce the work of the farmers,” he says.

There are, however, notes of caution about the potential of these businesses. Omair Ansari, emerging consumer market analyst at Renaissance Capital, says it is too early to know the scale of this niche sector but queries its profitability.

Widespread internet access is planned but is currently low, he says, while credit cards and mobile payment platforms like Kenya’s Mpesa are still relatively rare. Furthermore, these schemes are directed at a high earning middle class and while that demographic is growing, it’s a slower growth than initially predicted. A recent Credit Suisse report suggests only 19 million people on the continent should be considered middle class. Ansari predicts that online grocery delivery companies will struggle to make money until those challenges are overcome.

“Among the upper middle and upper class there is a demand but that is also finite. You see stupendous growth rates of e-commerce because it simply didn’t exist before, but that also has a cap on it when the rest of the population doesn’t have access to mobile data. You can launch it now but it will end up costing you until that [internet] penetration rate kicks through. So the scalability isn’t huge until logistics, mobile broadband and the cost of data are sorted,” he said.

Wachangai remains buoyant. “People working in farming will be the next millionaires and it will only come through innovation like ours.”

source : The Gurdain

Comments System WIDGET PACK

.jpg)