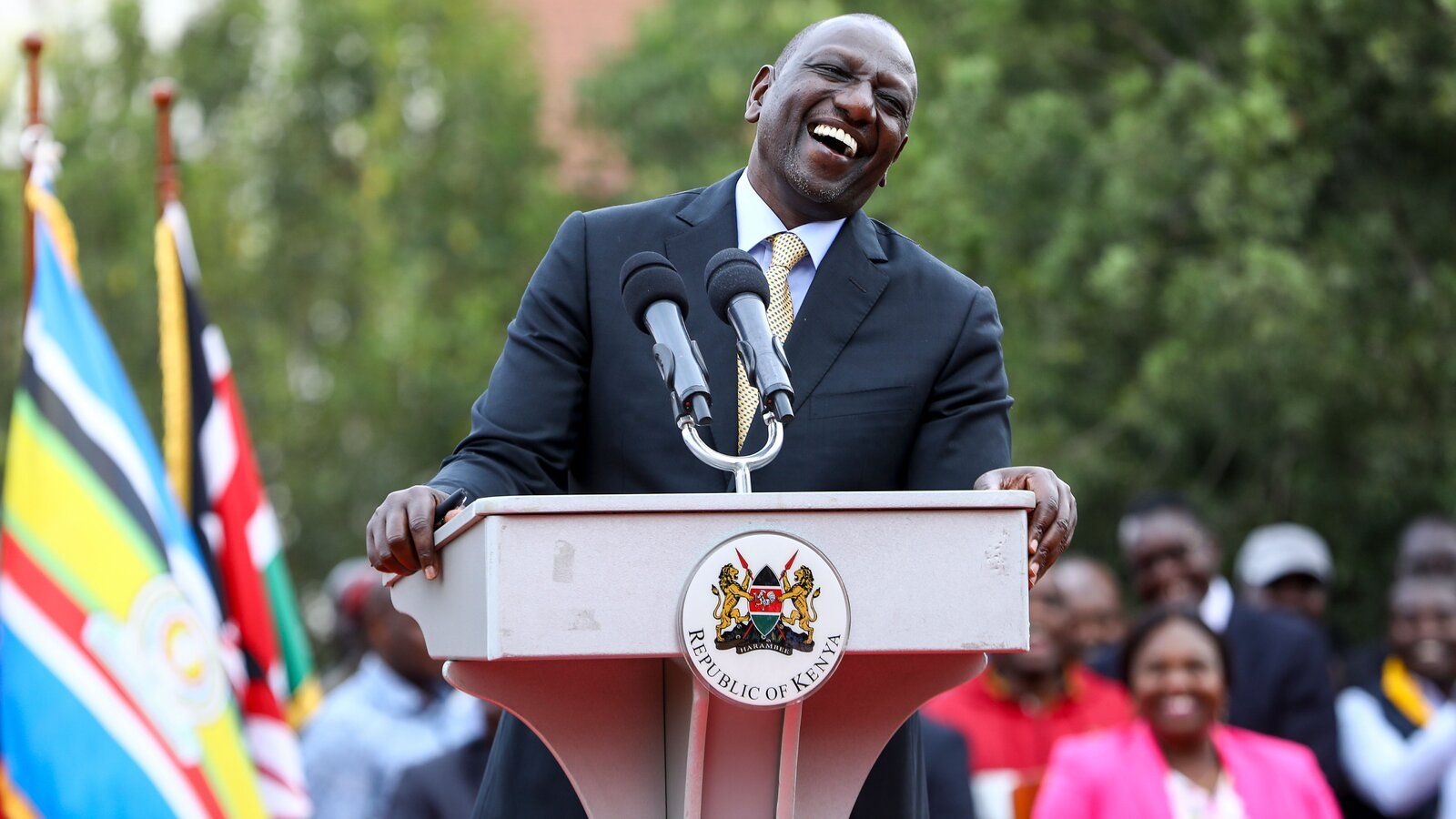

Delivery of affordable housing suffered setback in 2022 , say experts

FILE PHOTO -AFFORDABLE HOUSES IN AFRICA

Notwithstanding the poor performance of the economy in the outgoing year, the real estate industry has shown resilience amid high inflationary trend, cost of living crisis and other unfriendly policies that almost crippled investment in Africa.

Experts attributed the gains to the ability of the industry to withstand socio-economic shocks, being private sector led and carefulness by operatives in financial transaction management.They noted that a more worrisome development within the year was the high rate of insecurity and low value of the african currencies which forced many investors to become risk averse as developers reviewed prices while others suspended construction.

This affected the costs of building materials such as reinforcement, sand, roofing sheet, tiles, cement and granite, whose prices rose by over 80 per cent.

A report by the Guardian newspaper in Nigeria also indicated that over 60 per cent of the total cost of housing construction is spent on materials, which are mostly imported, while the remaining 40 per cent is spent on labour. Many estate managers and developers did not enjoy the best of times in the sector as they experienced slowed transactions due to other issues like cost of acquiring land/title, scarcity of skilled labour, fluctuating foreign exchange, logistics problems, and supply bottlenecks that affected projections.

These impacted the price of rentals in major cities like Lagos, Abuja, Ogun, Ibadan, Port Harcourt and Kano, with homeowners and property managers increasing rent by 80 per cent in almost all locations across the country. The average price of one-bedroom flats for rent in a highbrow location in Lagos rose to about N900, 000 yearly. Rentals for three bedrooms start from N1.9 million to over N4 million.

The paper added that The National Housing Programme (NHP) of the Federal Government, although on course, could not make much impact in bridging the existing housing deficit due to paucity of funds and outstanding liabilities of about N191.75 billion as revealed by the government.Despite the challenges, Nigeria’s construction and real estate sectors contributed N20 trillion to the Gross Domestic Product (GDP) as attested to in a recent report by the National Bureau of Statistics (NBS). The report showed that the construction and real estate sectors contributed the amount in the first three quarters of 2022 while construction services earned N12.9tr, real estate contributed N7tr to the GDP.

Source : Joycelyn Marigold -Africa Home Building News

PROPERTY EXPRESS VIDEO NEWS

Comments System WIDGET PACK

.jpg)