First-time buyers' £50,000 rent bill

First-time buyers in the UK who purchase a house this year will have already spent £52,900 on rent, research for a landlords' trade body suggests.

The cost will rise to £64,400 for those starting to rent now, figures published by the Association of Residential Lettings Agents (Arla) claim.

Rent will account for 16.4% of total lifetime earnings for today's first-time buyers in England.

The research also reveals wide regional variations.

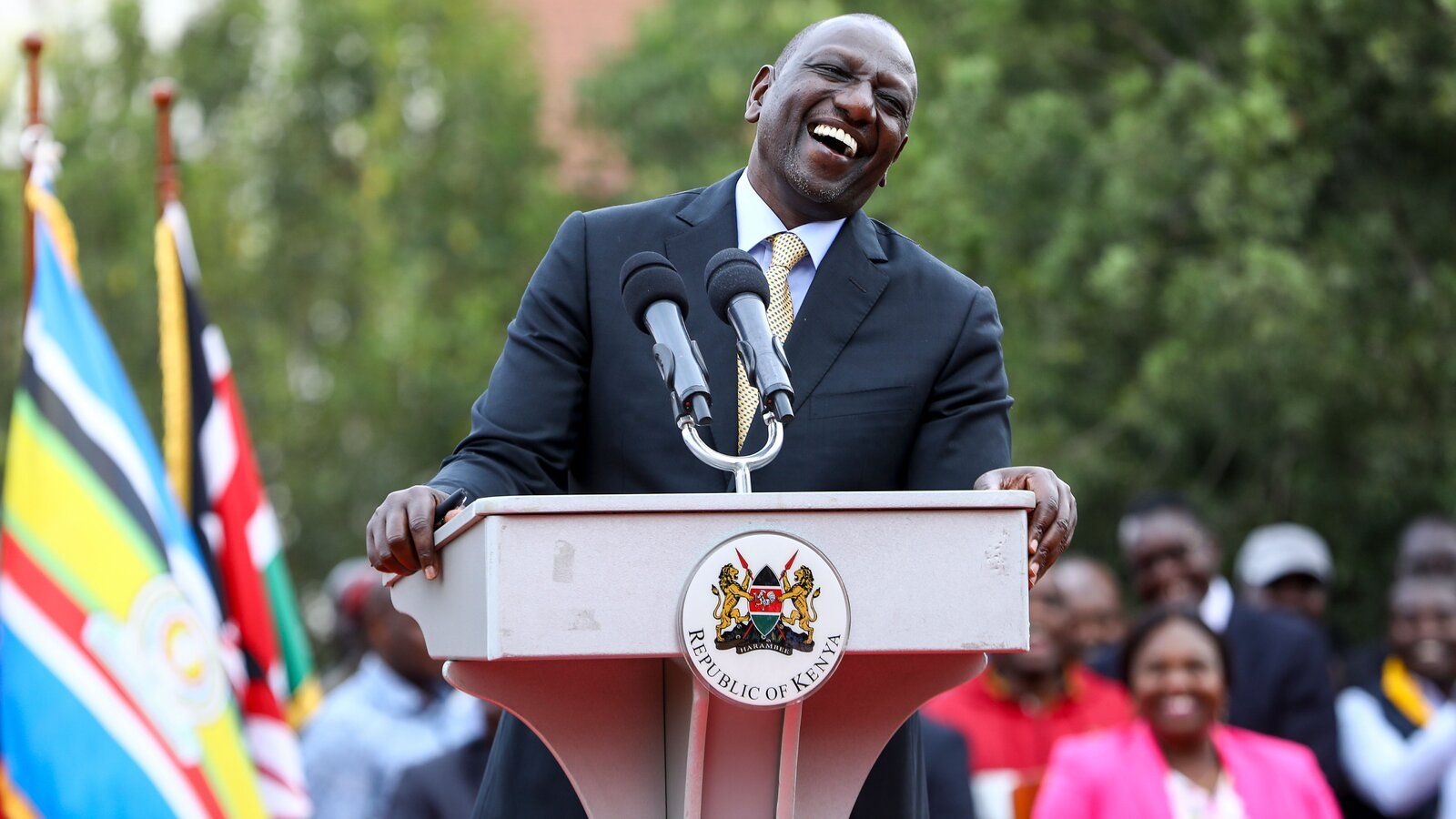

"Rents are becoming alarmingly unaffordable due to the lack of available housing; the north-south divide we're currently seeing in the UK is a clear illustration of this," said David Cox, managing director of Arla.

"The London rental market is competitive, with far more prospective tenants looking for properties than actual houses available. This is pushing up rents in the capital, which will continue to put pressure on surrounding areas, including the south east of England, as Londoners relocate to avoid high rent costs."

Those buying a property for the first time this year in London had spent an average of £68,300 on rent, the figures suggest.

The south east of England is the only region other than London where the total lifetime rent spent is above the English average, where total rent expenditure equates to £55,900, the research by the Centre for Economic and Business Research says.

In the north east of England, first-time buyers will have spent £31,300 on rent - the lowest amount in England.

House price calculato

Source :BBC

Comments System WIDGET PACK

.jpg)