Home Building & Property Video News 26/08/2022

Property, Home Building News and analysis brought to you by PE Live- My Name is Nana Yaa Okyerebea

The Headlines

Ghana’s construction sector contributed an average of 7.5% to annual GDP between 2013 and 2020

Experts shares insight on Ghana’s growing property market

Housing fair opens in Accra

And on the international front

Bankers are steadily loosening their purse strings for builders.

Real estate experts in Ghana say the country’s property market is increasing and have called on investors to consider investing into the market

The experts also indicate that the demand in Ghana for property keeps skyrocketing – the 2021 Population and Housing Census report estimated the country’s housing deficit in excess of 1.7 million, with current annual supply pegged at 40,000 units, against the required annual supply of 200,000 units.

This high sector-demand is further widened by the strong interest from foreign business and tourism travelers.

According to them that is huge investment on returns as Ghana’s property industry is currently among sectors providing high Returns on Investment (ROI).

According to the UN-SDG Investor Map, investments in the real estate sector have a returns profile ranging from 20 per cent to 25 per cent, depending on the size of project. Also, positive returns are expected on affordable house construction within a period of 10 years.

Additionally, there is a growing demand for luxury property, creating a niche market for estate developers.

The demand is attributed to the rapidly expanding middle class, elites, and educated professionals in the country, who desire homes that go well with their sense of style and way of life.

They further stipulate that Government offers several enticing initiatives to encourage private sector participation in the real estate market

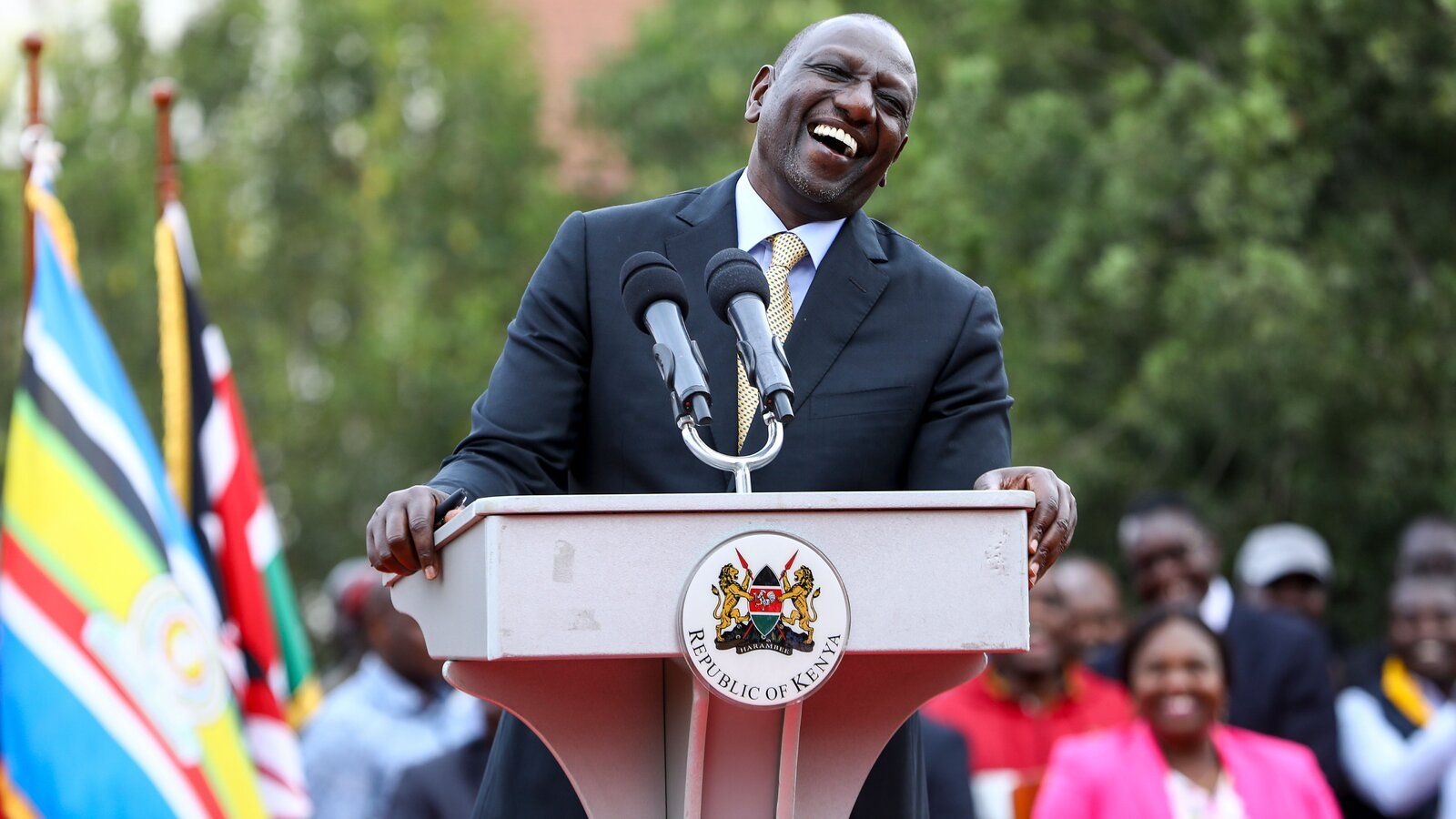

A housing fair jointly organized by, an Accra based media organization and Eco bank Ghana PLC has opened in Accra.

The event according to the organizers is expected to attract thousands of potential house owners who will be connected to mortgage financing by the headline sponsor,

It would also give key stakeholders and companies involved in the real –estate value chain a platform to share ideas and also offer attractive discounts on their products and services.

Adding that the initiative is expected to boost patronage of the event and patrons and exhibitors would also receive prizes.

Patrons would also benefit from a seminar on housing, financing and other related matters.

Key stakeholders for this year’s Eco bank/Joy News Habitat Fair are also poised to provide solutions to bridge Ghana’s housing deficit.

The five-day event is themed Homeownership: Where you live matters’ and is expected to attract about 100 exhibitors that are expected to showcase their products and services to patrons.

Ghana’s construction sector contributed an average of 7.5% to annual GDP between 2013 and 2020.

This was contained in a report by the oxford business group, a global research and advisory company

Ghana’s construction sector was also ranked the seventh largest in sub-Saharan Africa by Fitch Solutions in August 2021.

According to the 2022 budget statement released in November 2021, the sector also expanded by 8.2% year-on-year in the first six months of 2021.

this represented a growth of 2.9% and marked a strong recovery from the 4.4% contraction experienced in 2019.

Touching on cement, the report indicated that Ghana’s eight cement manufacturers have a combined capacity of some 13m tonnes annually.

With annual cement consumption pegged at about 6.5m tones, the domestic market continues to suffer from oversupply due to excessive imports.

Cement prices also stabilized throughout 2020 but rose during 2021 due to the high cost of clinker, a key raw material in production that was not available locally

It added that the activation of the African continental free trade represents major developments to support robust, sustained growth in the construction industry.

Professionals in the real estate value chain say building a property in the country requires strict adherence to certain rules and regulations.

All projects should be carried out in accordance with the National Building Regulations and any other applicable municipal or metropolitan laws, such as obtaining all necessary approvals and permits before commencing construction.

To navigate through the process, prospective property owners should be abreast with necessary requirements such as site clearance, design and building permits.

At a basic level these include town planning laws, environmental protection laws, heritage preservation laws and fire safety laws.

One must also obtain approval from the relevant authorities. Such an approval is based on the type of property being put up and the location.

Money is critical in such a project hence one may secure a loan from a financial institution who invest in new buildings or home renovations.

Hiring a right team is also essential and ensure the professionals are licensed and endeavor to discuss your budget with them before commencement of the project.

Additionally, an engineer should be hired to ensure all structural calculations are accurate and all materials are appropriate for use in the country.

Professionals in the industry also advise that Building regulations should be adhered to avoid demolition of a building project.

And on the International Front

Global Real estate financing and mechanisms are undergoing a change as the banking sector’s credit to the property developers have increased steadily following the Covid-19 pandemic.

Commercial banks net credit to the real estate sector witnessed 3.5 times growth during 2021, as compared to the pandemic period. This was attributed to the low-interest regime and relaxed lending norms.The high growth momentum continued in the first five months of the year with a net.

The experts say the increase in policy rates by 140 basis points and subsequent rise in lending cost is likely to result in developers turning to institutional investors for equity financing and even divestment of assets.

Additionally Residential real estate witnessed robust recovery post the waning of the pandemic.

Apart from robust housing sales momentum, the office sector also witnessed 26 million sq ft of net absorption in 2021 despite the surge in remote jobs and hybrid work model revving up the growth cycle.

This improved cash flow positions of developers due to brisk home sales.

The improved balance sheets helped developers access credit from the banking sector at low lending rates and the same was reflected in growth in net credit disbursals.

However, realty developers are expected to benefit from the lower lending rates over the next few months only, as the lending rates have started to increase.

Source : Diana Okyerebea - PE News

Comments System WIDGET PACK

.jpg)