Green buildings in Accra to increase to over 20% of total building floor space by 2025: Estate Intel

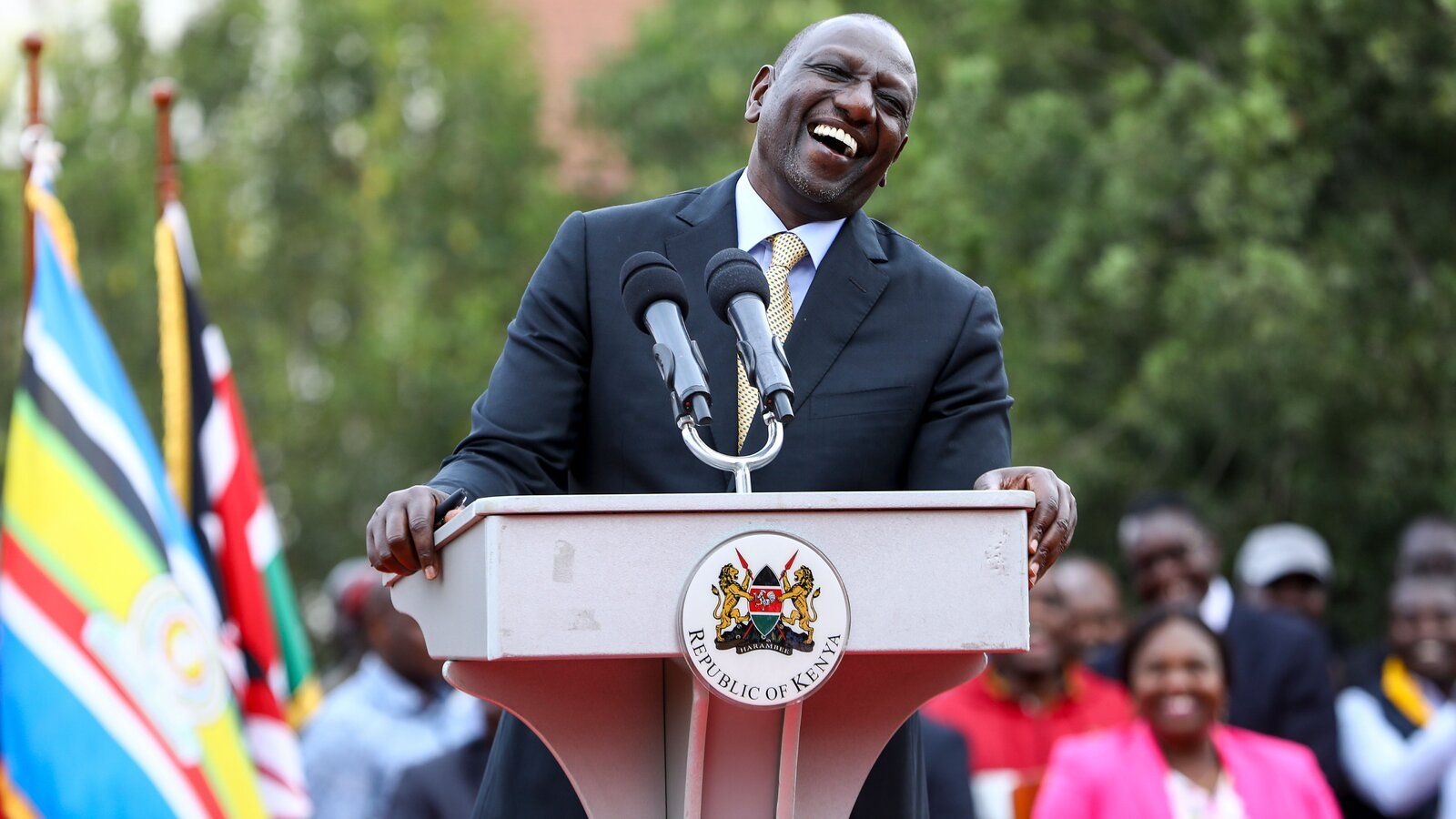

Photo File

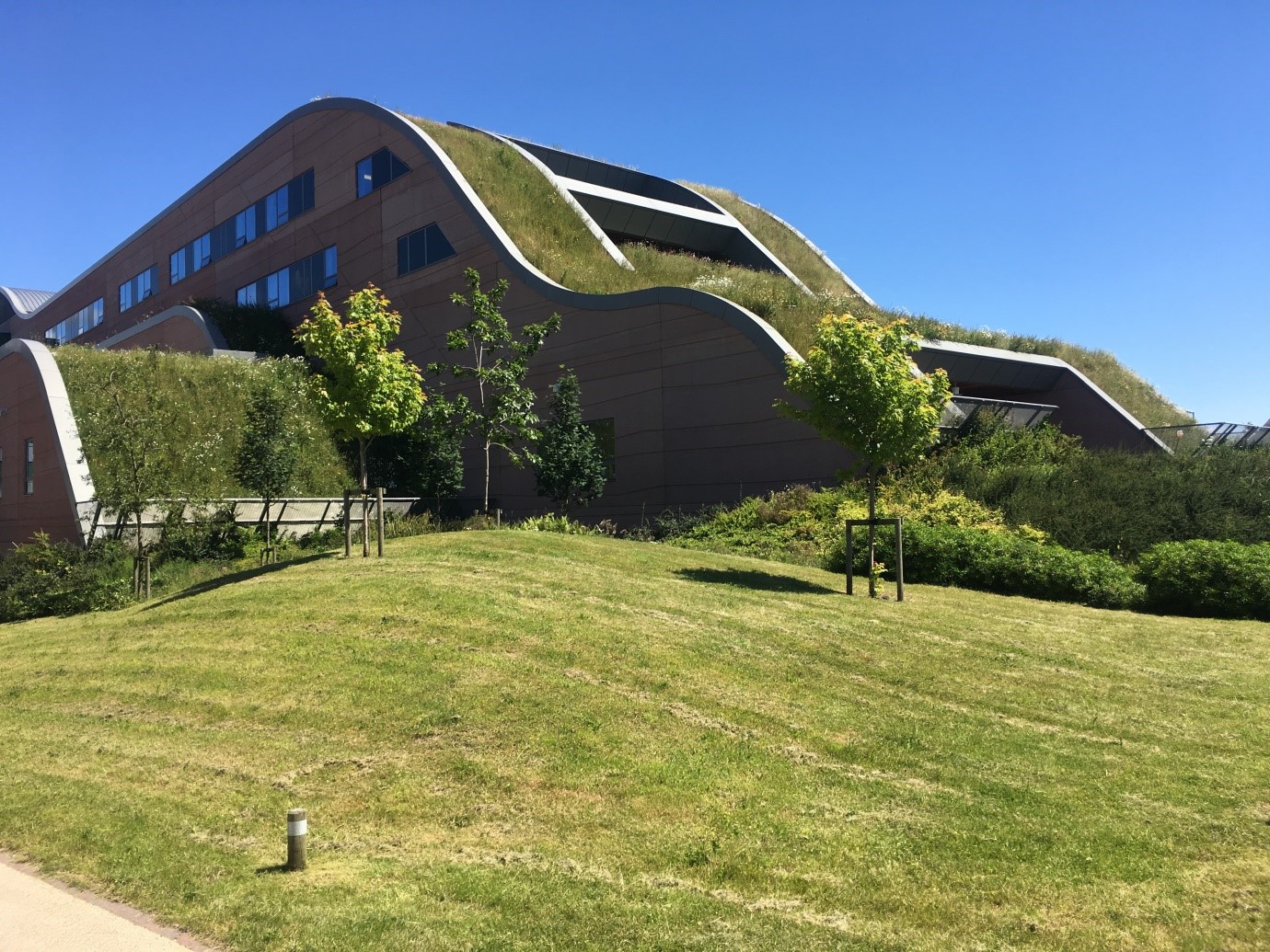

A report released by: Estate Intel, a data platform indicates that a key emerging theme in Accra’s property market has been the increasing adoption of green building standards by developers. No longer a nice to have, green building standards are emerging as a key measure of quality in Accra’s market.

It added that The International Finance Corporation estimates that green buildings in Accra will increase to just over 20% of total building floor space by 2025. Offices, warehousing, hotels, and apartment sub-sectors are expected to lead the pack with penetration projected at approximately 22%,

On the other hand, healthcare and single-family residential rank the lowest with penetration expected at only 2% of total floor space by 2025.

It added that like the Lagos residential market, Accra faces an undersupply of housing units, with the mid to low end sector accounting for the majority of the demand.

It found that while there are up to 800,000 residential units in Accra, the development pipeline is set to bring an additional 23,000 units onto the market. This will account for approximately 3% of the total stock, with the majority of this pipeline (80%) falling within the middle income to affordable sectors.

BOOK YOUR PLACE HERE TODAY

The report indicated that the mid to low-end residential segments also continue to record relatively high occupancy rates owing to the domestic nature of demand. On the other hand, vacancy rates remain high at approximately 20% in the prime residential segment of the market due to a decline in demand from expatriates and multinational employees. However, the short let segment of the market has continued to see increasing demand with tourists and business travelers preferring this medium to hotels., Overall, the outlook for the prime residential sector remains negative while the mid-low end segment is positive.

SELLING NOW - 4 BED ROOM TOWN HOMES

Touching on the impact of increasing fuel costs on the real estate market, it added that as the prices of other commodities rise in response to the spike in fuel and global energy costs, the real estate sector in Accra has not been any different. Typically, real estate investors and property owners leverage this fuel hike to increase residential prices.

As a result, the mid-low end of the market is expected to continue to outperform prime residential, particularly with fuel prices set to continue rising for the foreseeable future. In addition, as the hunt for quality intensifies and property owners continue to repurpose their properties into mid to high-end properties, it projects an influx in prime residential supply in the market which would impact prime residential performance even further.

READ FREE THE LATEST EDITION OF OUR E-MAGAZINE

Joycelyn Marigold -PE News

Comments System WIDGET PACK

.jpg)