New fuel price a rip-off by OMCs-ACEP threatens court

Energy policy think-tank, African Center for Energy Policy (ACEP) says consumers have been cheated by Oil Marketing Companies in the latest fuel price reductions.

Energy policy think-tank, African Center for Energy Policy (ACEP) says consumers have been cheated by Oil Marketing Companies in the latest fuel price reductions.

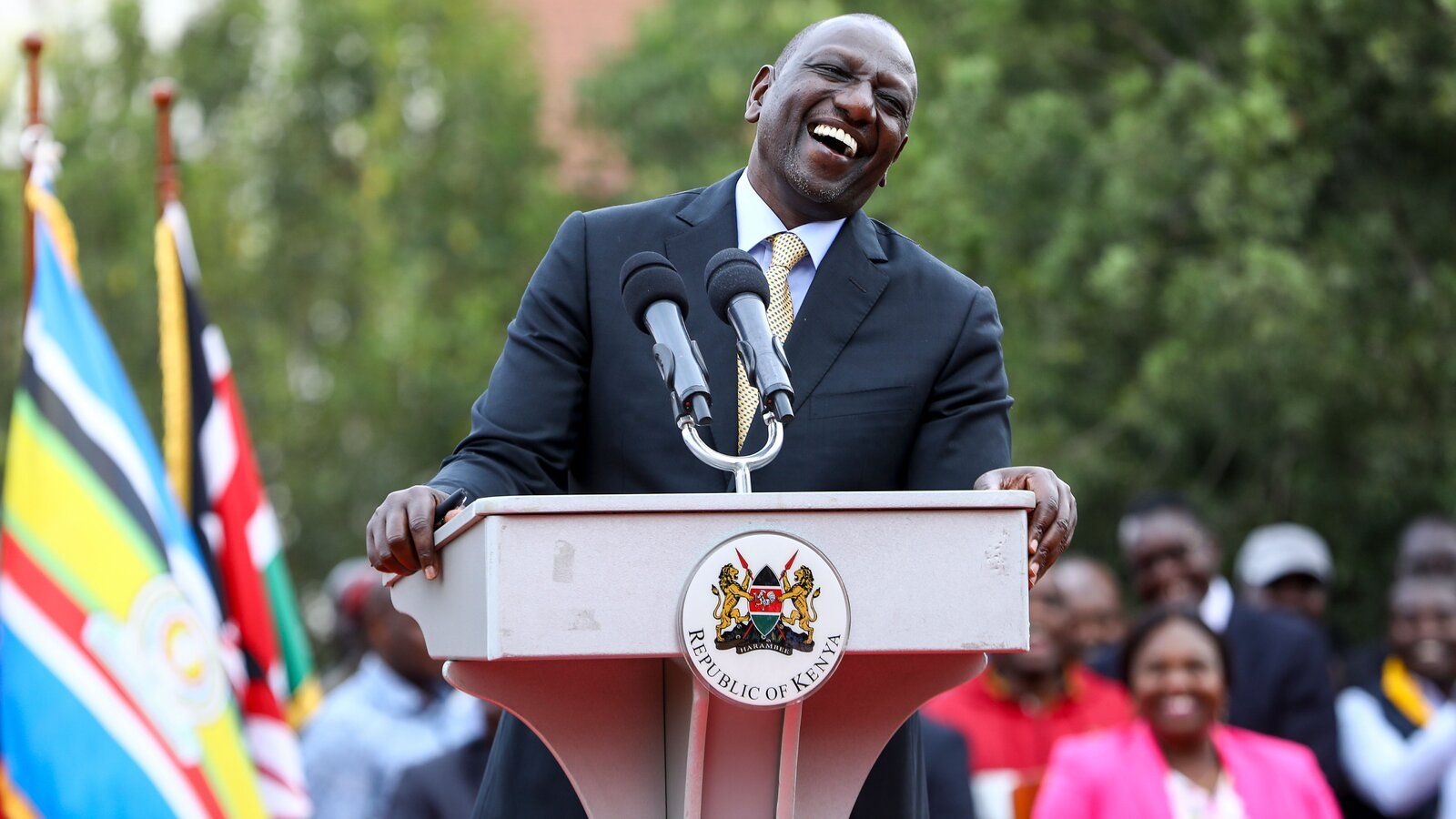

At a press conference Friday, ACEP’s Mohammed Amin Adams presented computations that explained that the price reductions could have gone further down

Fuel prices have gone down at the pump between 10-15 percent following significant appreciation of the Ghana cedi against the dollar.

With Ghana sticking with an enhanced price deregulation policy, OMCs are now free to set its individual prices within a formula provided by the Bulk Oil Distribution companies.

Per the new prices, petrol is now being sold between ¢15.00 to ¢16.00 down from the 18.00 cedis it was sold at prior to the reduction.

ACEP accused all OMCs of having “short changed” consumers. There are at least 60 OMC licensed to operate in Ghana

In a press statement Friday, Amin Adams revealed, a company like Total and Allied Oil should have reduced their prices by 17% instead of 11% and 13% respectively.The state-owned company Goil should have gone down further by 18% and not 14%, ACEP said.

Mohammed Amin also accused the BDCs of working in concert with OMCs to rip consumers off.

He described the actions of the OMCs as criminal and a breach of the law. ACEP says it is prepared to go to court if consumers are willing to fund its legal fees.

PRESS STATEMENT BY THE AFRICA CENTRE FOR ENERGY POLICY (ACEP) ON THE REDUCTION IN THE PRICES OF PETROLEUM PRODUCTS BY THE OIL MARKETING COMPANIES.

PRESENTED BY DR. MOHAMMED AMIN ADAM, EXECUTIVE DIRECTOR ON 16TH JULY 2015

Last Week, the Africa Centre for Energy Policy expressed our support for the deregulation of the downstream petroleum industry. We enumerated the benefits of the price deregulation to consumers because we believe that it would generate competition and bring the prices of petroleum products down. We also urged caution expressing our fear about possible abuse of the market for purposes of exploiting consumers. With the announcement of new prices of petroleum products, we have cause to believe that our fears have been confirmed.

We have evidence to show that the prices as announced by the OMCs do not reflect the market forces as demonstrated by the indicators that affect the pricing of the products.

The indicators used in the determination of the Ex-refinery Index, the major index influencing petroleum product prices are:

PRICE INDICATORS

|

Exchange rate (GHs/US$) |

|

||

|

3.4755 |

|

||

|

Change in Exchange rate |

- 25.26% |

||

|

Average World Market Price (USD/MT) - Premium |

717.25 |

||

|

Average World Market Price (USD/MT) - GASOIL |

542.78 |

||

Based on these indicators, the Chamber of Bulk Oil Distributors computed the XPi and published them for the various products. ACEP however recognizes that the XPi used in the computation of ex-pump prices were the minimum based on 17% reduction, instead of the 23% for Petrol and 25% for Diesel.

COMPUTATION OF EX-REFINERY INDEX (GHS/LTR)

|

Jul-16 |

|

||

|

BDCs - Current |

Jul-01 |

Maximum |

|

|

XPi - Premium |

258.7454 |

214.7587 |

199.2339 |

|

Change (- %) |

|

17% |

23% |

|

XPi - GASOIL |

231.7433735 |

192.347 |

173.6221354 |

|

Change (-%) |

|

17% |

25% |

Therefore, as we can see, the Indicative Ex-Pump Prices of Petrol and Diesel for the current price window should have been GHp329.81/Ltr for Petrol and GHP293.28/Ltr for Diesel. Contrary to these, the OMCs announced various prices which are completely are variance with the actual indicative prices at the pump.

|

FUEL PRICE BUILD UP |

||

|

|

PREMIUM Ghp/Ltr |

GASOIL Ghp/Ltr |

|

Xpi (Minimum) |

214.7587 |

192.347 |

|

RECOVERY MARGIN |

||

|

EX-REFINERY PRICE |

214.7587 |

192.347 |

|

EXCISE DUTY |

2.78 |

1.8 |

|

TOR DEBT RECOVERY LEVY |

8 |

8 |

|

ROAD FUND |

7.3231 |

7.3231 |

|

ENERGY FUND |

0.05 |

0.05 |

|

EXPLORATION |

0.1 |

0.1 |

|

CROSS-SUBSIDY LEVY |

5 |

-2.6987 |

|

PRIMARY DISTRIBUTION MARGIN |

6.5 |

6.5 |

|

BOST MARGIN |

3 |

3 |

|

FUEL MARKING MARGIN |

1 |

1 |

|

EX-DEPOT |

248.5118 |

217.4214 |

|

SPECIAL PETROLEUM TAX |

43.4897483 |

38.04891654 |

|

UPPF |

10 |

10 |

|

MARKETERS MARGIN |

16.67 |

16.67 |

|

DEALERS (RETAILERS/OPERATORS) MARGIN |

11.14 |

11.14 |

|

LPG FILLING PLANT/Premix/MGOLocal Admin Costs |

||

|

DISTRIBUTION COMPENSATION MARGIN |

||

|

PROMOTION MARGIN |

||

|

Indicative Ex Pump Price |

329.8115483 |

293.2803165 |

|

|

|

|

Now we compare the prices of products from the 1 – 15 July window (Old Price) and the 16 – 30 July window (New Price) relative to the actual indicative prices.

FUEL PRICES – OLD, NEW AND THE EXPECTED INDICATIVE PUMP PRICE

|

OMC |

ALLIED |

TOTAL |

GOIL |

|

PREMIUM - 1 July |

3.978 |

3.979 |

3.79 |

|

PREMIUM - 16 July |

3.45 |

3.53 |

3.46 |

|

EXPECTED INDICATIVE PUMP- PREMIUM |

3.298 |

3.298 |

3.298 |

|

GASOIL - 1 July |

3.736 |

3.737 |

3.57 |

|

GASOIL - 16 July |

3.06 |

3.14 |

3.07 |

|

EXPECTED INDICATIVE PUMP - GASOIL |

2.933 |

2.933 |

2.933 |

The changes in prices of products announced by the OMCs suggest that the OMCs are exploitative, taking advantage of the deregulation policy to cheat consumers. This departs from the objective of the Government for introducing the deregulation policy in the downstream petroleum industry. A comparison of the prices of a few sampled OMCs are as follows, all showing that the reduction in fuel prices should have been more than what the OMCs announced. For example, our computations reveal that Total and Allied Oil should have reduced the prices of Petrol by 17% instead of the 11% and 13% they announced respectively. Goil should have decreased its price for Diesel by 18% instead of 14%.

CHANGE IN PRICES - CURRENT CHANGE VERSUS EXPECTED CHANGE - with minimum XPI

|

OMC |

CHANGE -PREMIUM |

EXP CHANGE -PREMIUM |

CHANGE -GASOIL |

EXP CHANGE -GASOIL |

|

|

ALLIED |

13% |

17% |

18% |

21% |

|

|

TOTAL |

11% |

17% |

16% |

22% |

|

|

GOIL |

9% |

13% |

14% |

18% |

|

What is surprising however is that, it is not only the OMCs that are cheating consumers. The BDCs have also been involved in this bad faith. They decided to give their products to the OMCs based on a reduction in the XPI by 17% instead of the actual 23% reduction for petroleum and 25% reduction for Diesel as dictated by the XPi indicators particularly the fall the value of the US Dollar by 25% over the period under consideration. Therefore, if the maximum reductions in the XPi were applied, the reduction in ex-pump prices could have even been more significant.

MAXIMUM XPI SCENARIO

|

FUEL PRICE BUILD UP |

||

|

|

PREMIUM Ghp/Ltr |

GASOIL Ghp/Ltr |

|

Xpi (Maximum) |

199.2339 |

173.6221354 |

|

RECOVERY MARGIN |

||

|

EX-REFINERY PRICE |

199.2339 |

173.6221354 |

|

EXCISE DUTY |

2.78 |

1.8 |

|

TOR DEBT RECOVERY LEVY |

8 |

8 |

|

ROAD FUND |

7.3231 |

7.3231 |

|

ENERGY FUND |

0.05 |

0.05 |

|

EXPLORATION |

0.1 |

0.1 |

|

CROSS-SUBSIDY LEVY |

5 |

-2.6987 |

|

PRIMARY DISTRIBUTION MARGIN |

6.5 |

6.5 |

|

BOST MARGIN |

3 |

3 |

|

FUEL MARKING MARGIN |

1 |

1 |

|

EX-DEPOT |

232.987 |

198.6965354 |

|

SPECIAL PETROLEUM TAX |

43.4897483 |

38.04891654 |

|

UPPF |

10 |

10 |

|

MARKETERS MARGIN |

16.67 |

16.67 |

|

DEALERS (RETAILERS/OPERATORS) MARGIN |

11.14 |

11.14 |

|

LPG FILLING PLANT/Premix/MGOLocal Admin Costs |

||

|

DISTRIBUTION COMPENSATION MARGIN |

||

|

PROMOTION MARGIN |

||

|

Indicative Ex Pump Price |

314.2867483 |

274.5554519 |

|

3.1429 |

2.7456 |

|

|

|

|

|

A comparison of the price changes announced relative to the actual changes at the maximum levels of the XPi are presented as follows. For example, we should have seen a reduction in the pump price of Petrol by 21% by Allied Oil instead of the 13% it announced; or 27% reduction in the price of Diesel instead of the 18% it announced.

|

CHANGE IN PRICES - CURRENT CHANGE VERSUS EXPECTED CHANGE - with maximum XPI |

||||

|

OMC |

PREMIUM |

EXP CH-PREMIUM |

GASOIL |

EXP CH-GASOIL |

|

ALLIED |

13% |

21% |

18% |

27% |

|

TOTAL |

11% |

21% |

16% |

27% |

|

GOIL |

9% |

17% |

14% |

23% |

The interesting disappointment in these prices changes is that some of the OMCs are also BDCs (e.g. GOIL and ALLIED); and why they failed to apply the maximum XPi in the pricing of their products at the Pump is very worrying, pointing to price manipulation. The case of GOIL is more worrying as the State has a stake in the company; and should be seen to be supporting Government’s policy on deregulation rather than undermining. If GOIL applied its maximum XPi, it would have played its role in checking the market; and building the confidence of the consumer in the deregulation policy.

We would like to make a few observations that further justify why the reduction in fuel prices should have been more drastic.

- The exchange rate used in the computation of the XPi is GHS3.4755 to the US Dollar, which is now higher than the rate quoted by some currency traders. The extent to which the Fufex30 used by the Chamber of Bulk Oil Distributors reflects the market therefore remain questionable. But even at that rate, there is no reason for both the BDCs and OMCs to cheat consumers.

- The OMC’s have claimed the entire amount of GHp16.67, being the maximum marketing margin agreed between them and the NPA. Thus, none of the OMCs are making losses in spite of the differences in their cost structures. It is therefore totally wrong for them to deny consumers their rights over the appropriate reduction in the prices of petroleum products. This only shows that OMCs are exploiting consumers to satisfy their thirst for profiteering.

- Some OMCs are claiming that they are selling old stock of petroleum products which they bought at relatively higher prices. One wonders if they will make the same argument assuming the price indicators demanded an upward adjustment in product prices.

- We are yet to see what role the NPA will play in this price manipulation, cheating and exploitation by BDCs and OMCs. But what is more important is for consumers to know that the best regulator of the market is the consumer himself. Based on available data particularly data for the computation of the XPi, which the Chamber of Bulk Oil Distributors is now publishing, we can all monitor prices of products and to demand that justice is done to consumers as the petroleum deregulation policy enters its full force.

- Finally, it is important for the BDCs and OMCs to realize that there are criminal and civil remedies provided in the NPA Act 691 and the Protection Against unfair Competition Act of 2000; and we would not hesitate to seek legal redress to force the market to be fair.

Source: myjoyonline

Comments System WIDGET PACK

.jpg)