Kenya’s first mortgage-backed bond records a success – Capital Markets Authority

Kenya’s first government-supported mortgage company raised 1.4 billion shillings (about 12.3 million U.S. dollars) in its initial bond issue, the capital markets regulator said Tuesday, indicating a major milestone for real-estate backed securities in the east African nation.

The bond, issued in January, attracted bids worth 71.3 million dollars, a massive subscription of 480 percent, said the Capital Markets Authority (CMA) in a statement issued in Nairobi, the Kenyan capital.

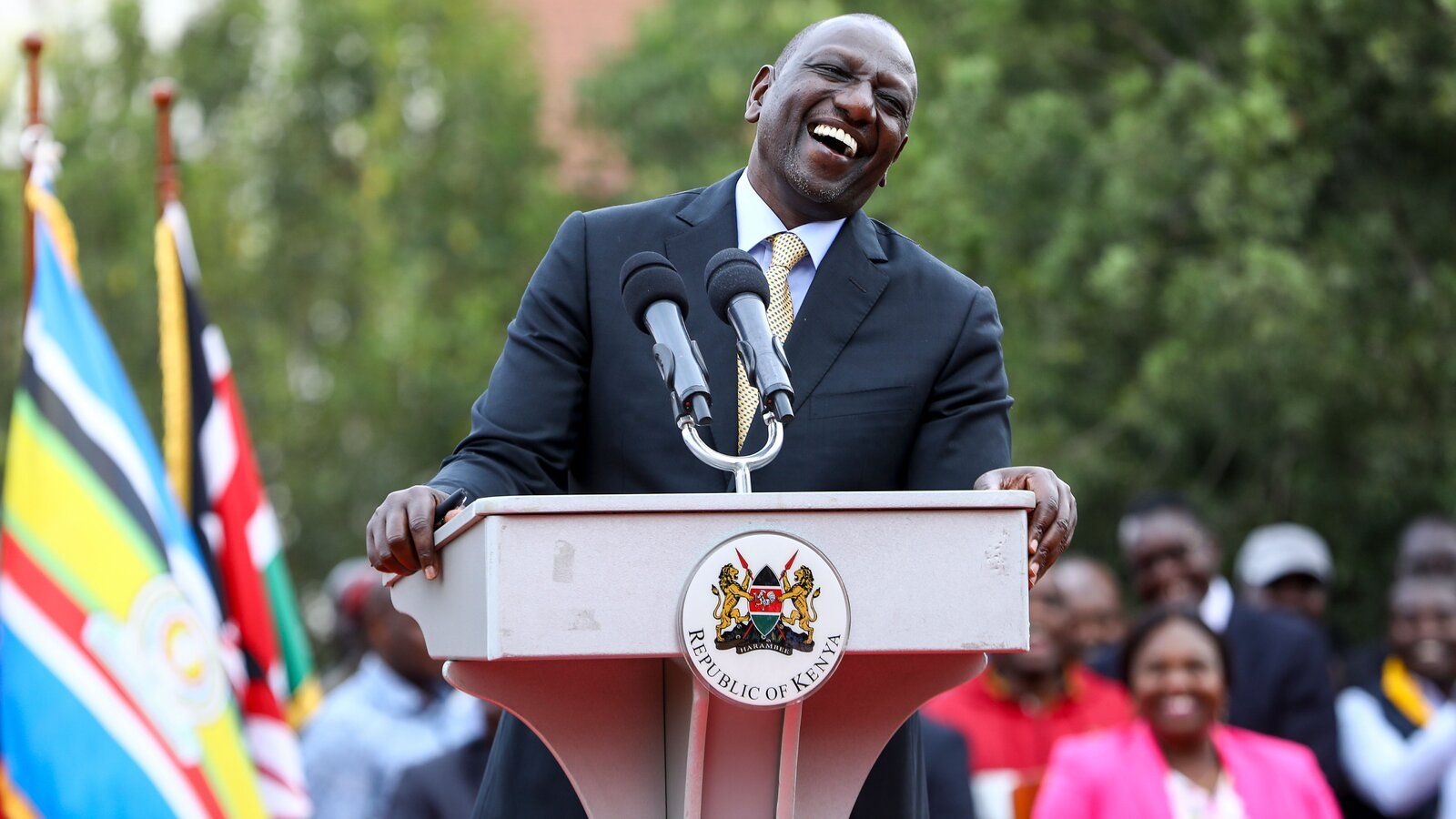

Wycliffe Shamiah, the chief executive officer of CMA, said the raising of the funds is a major milestone that shows that the market can be used as a source of money for critical areas of the east African nation’s economy.

“This affirms the growing issuer and investor confidence in the Kenyan bond market,” he added.

One of the constraints of the growth of the Kenyan housing sector is financing challenges, with mortgage uptake standing at less than 30,000 as home loans remain expensive for citizens while houses are unaffordable.

To address the challenge, the Kenyan government joined forces with commercial banks and the World Bank to set up the Kenya Mortgage Refinancing Company (KMRC).

The firm is expected to raise 92.4 million dollars in total in subsequent bond issues for mortgage lending.

The company lends money to mortgage lenders in the east African nation at lower rates for onward disbursement to working Kenyans in what is expected to boost homeownership. Enditem

Comments System WIDGET PACK

.jpg)