While the housing market has seen strong demand and rising prices over the past two years, we expect some big changes to come this year.

The residential property market has gone from strength-to-strength since the onset of the pandemic, mirroring the trends seen in most developed countries.

While the pandemic remains in 2022, vaccination rates are Australia are high and we’re living with the virus rather than suppressing it.

This is great news for society however, it is also likely to result in some shifting trends for the property market.

Here are the six potential changes in the residential property market to watch out for in 2022.

A slowing or reversal of the regional shift

The big shift in the housing market since the onset of the pandemic has been the ongoing rise of demand for properties in regional markets.

Prices have risen so rapidly that in many larger regional markets, particularly those close to capital cities, prices are in line or even in excess of those in the capital city markets.

While living and working in regional Australia has been a sensible lifestyle choice for many while people have been working from home, with restrictions easing and cities returning to life it is feasible that some of those people that moved regionally may return to the cities.

Furthermore, two years into the pandemic and with restrictions having eased it seems likely that the shift away from cities won’t be as significant in 2022 than it was over the two years prior.

The introduction of further macroprudential controls

In October 2021, the Australian Prudential Regulation Authority reintroduced macroprudential controls on lending for the first time since removing all previous controls in May 2019.

The changes made were fairly light touch and involved interest rate assessment buffers. Prior to these changes, borrowers were assessed for a mortgage based on their ability to repay a mortgage at an interest rate 2.5 percentage points above the offered interest rate and once these changes were introduced that buffer increased to 3 percentage points.

While macroprudential policies don’t target property price growth, housing credit growth is a key consideration, and it continues to climb and is increasing at a rate well above household incomes.

Given this, should credit growth continue to accelerate in 2022 it would seem likely that additional macroprudential controls could be introduced and the likely impact would be making it more difficult to access credit which in-turn likely slows sales activity and price growth.

There are a variety of measures that may be implemented but some of the more likely macroprudential tools we could see implemented in 2022 would be lending caps for higher risk loans, further increasing serviceability assessment criteria, restrictions on loan to deposit ratios or limits on debt-to-income ratios.

It should be noted that nothing here is imminent to our knowledge and if price growth slows then any additional restrictions may not be required.

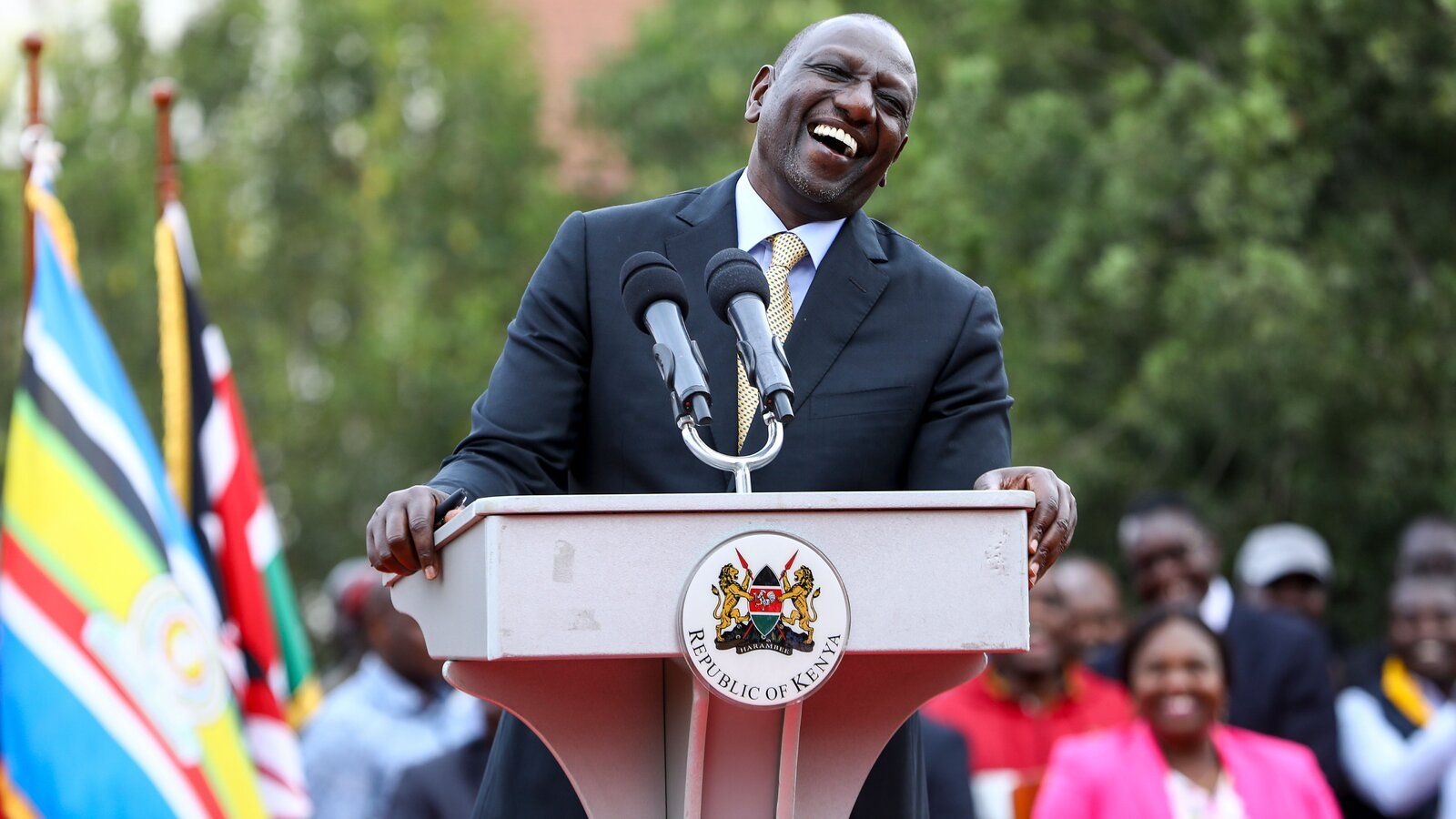

BOOK YOUR SEAT NOW

BOOK YOUR SEAT NOW

Stronger price growth in smaller capital cities

While prices continue to rise nationally, Sydney and Melbourne have been experiencing a slower rate of price growth since the middle of last year and we expect that this will continue in 2022.

Price rises in Brisbane, Adelaide and Hobart are showing little if any sign of a similar slowing with demand for properties in these markets also remaining much stronger than in the larger capital cities.

We tend to think of greater workplace flexibility meaning that people move to regional areas and work from home we shouldn’t forget that flexibility might also mean that instead of working from a Sydney or Melbourne head office people may be able to do their head office job from Brisbane, Adelaide or Hobart.

There are also obvious benefits for some people in making this move with the cost of housing outside of Sydney and Melbourne being much lower and both large capital cities a relatively easy flight away if people need to travel to head offices on a regular basis.

Our expectation is that in 2022 housing demand will remain stronger in these smaller capital cities than in Sydney and Melbourne and subsequently they will also experience stronger price increases yet still retaining much lower prices than these other capital cities.

The return of overseas migration increasing demand for inner city rentals

The inner-city rental markets, particularly apartment rentals, have seen the largest prices falls since the onset of the pandemic. These markets have been hindered by the closing of borders and universities shifting to virtual learning.

With Australia’s domestic and international borders now largely reopening, universities returning to in-person lectures and people returning to offices throughout 2022 we expect demand for inner city rentals to continue to lift.

CBDs and inner-city areas are expected to spring back to life in 2022 and sports and other forms of entertainment will also return bringing that vibrancy back to the inner-city which has been missing since the onset of the pandemic.

With this reopening we expect the desire to live closer to the activity will also rebound driving a desire, particularly for students and younger professionals, to rent in this market once again.

A key theme over the past year has been disruption and it is applicable to people’s lives, businesses and of course the property market.

If there’s one thing the pandemic has taught us it’s that there’s no guarantees for what the future holds however, it is looking increasingly less likely that the lockdowns and restrictions of the past two years will return.

Since these restrictions have been place, homeowners have spent less money on things like entertainment, dining out, movies, concerts, tolls, car parking and public transport not to mention on domestic and overseas travel. As a result, many households have been willing to dedicate more of their income to housing costs.

With restrictions eased it is likely that people will want to spend more on these things they haven’t been able to spend on and less on housing over the coming years.

Furthermore, many people have already made a housing move during the pandemic due to incentives in place and historic low mortgage rates this is highlighted by a 40% year-on-year increase in sales in 2021.

Given all this, fewer market disruptions and more freedom is likely to result in reduced overall demand for housing in 2022 which in-turn is a contributor to an expected slowing of price growth throughout the year.

Interest rate hikes late in the year

At this stage we expect the Reserve Bank (RBA) to keep rates unchanged this year, the likelihood of a cash rate increase in 2022 has increased significantly due to the strong economic performance.

Since the onset of the pandemic the RBA has provided significant economic stimulus and support and have repeatedly stated that they don’t expect conditions for a rate increase will be met until 2024.

More recent communications have seen them drop that statement indicating it is now unlikely rates will be on hold until 2024 with many now expecting a rate increase or several increases in the second-half of 2022.

It’s also safe to assume that interest rates increase most lenders will also increase variable mortgage rates by an equivalent if not larger amount.

Lower mortgage rates have been a significant driver of the increase in prices seen over the past couple of years.

While rate hikes can take time to fully impact the economy holders of variable mortgages will be shortly paying higher interest rates while those on fixed rate mortgages will be rolling off their fixed terms into an environment of higher and possibly rising mortgage rates.

Households should start planning for these increases now and the likelihood of interest rate increases sooner will potentially create some market urgency initially but also take some of the exuberance out of the market regarding the rate of price growth.

.jpg)