Blackstone to Buy Bluerock Residential REIT for $3.6 Billion

Apartment REITs have soared in value this year. As of Nov. 30, the NAREIT apartment REIT index returned 46% year to date.

Blackstone’s (BX) - Get Blackstone Inc. Report real estate division has agreed to buy Bluerock Residential Growth REIT (BRG-C) - Get Bluerock Residential Growth REIT Inc 7.625 % Cum Red Pfd Registered Series C Report for $3.6 billion.

The transaction works out to $24.25 per share. Bluerock recently traded at $26.57, skyrocketing 72% from Friday’s close. That premium price may indicate investors expect a higher bid to emerge for Bluerock.

Apartment real estate investment trusts have soared in value this year. As of Nov. 30, the NAREIT apartment REIT index returned 46% year to date.

Under terms of the agreement, Blackstone will acquire 30 multifamily properties, comprising approximately 11,000 units as well as a loan book secured by 24 multifamily assets.

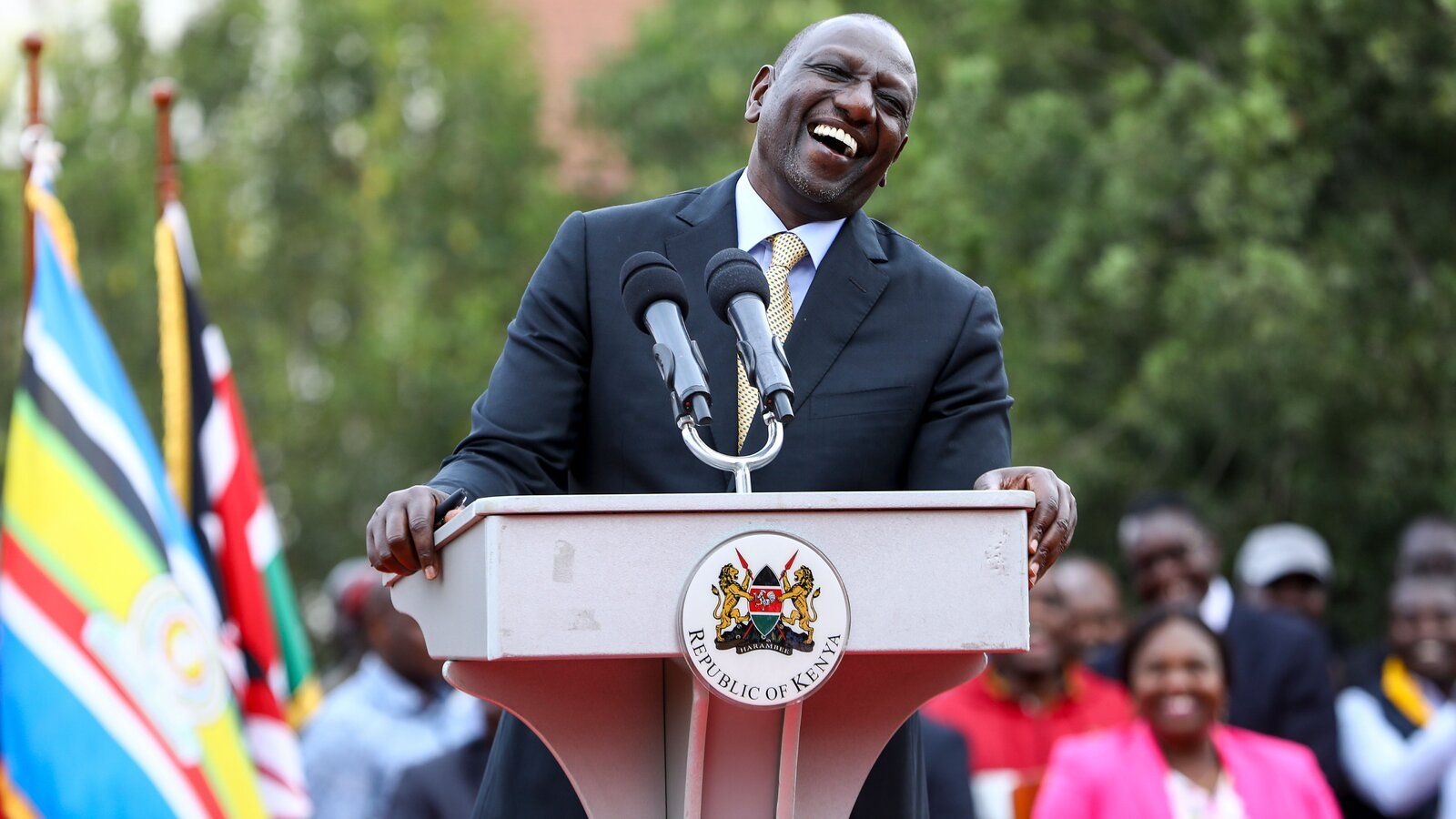

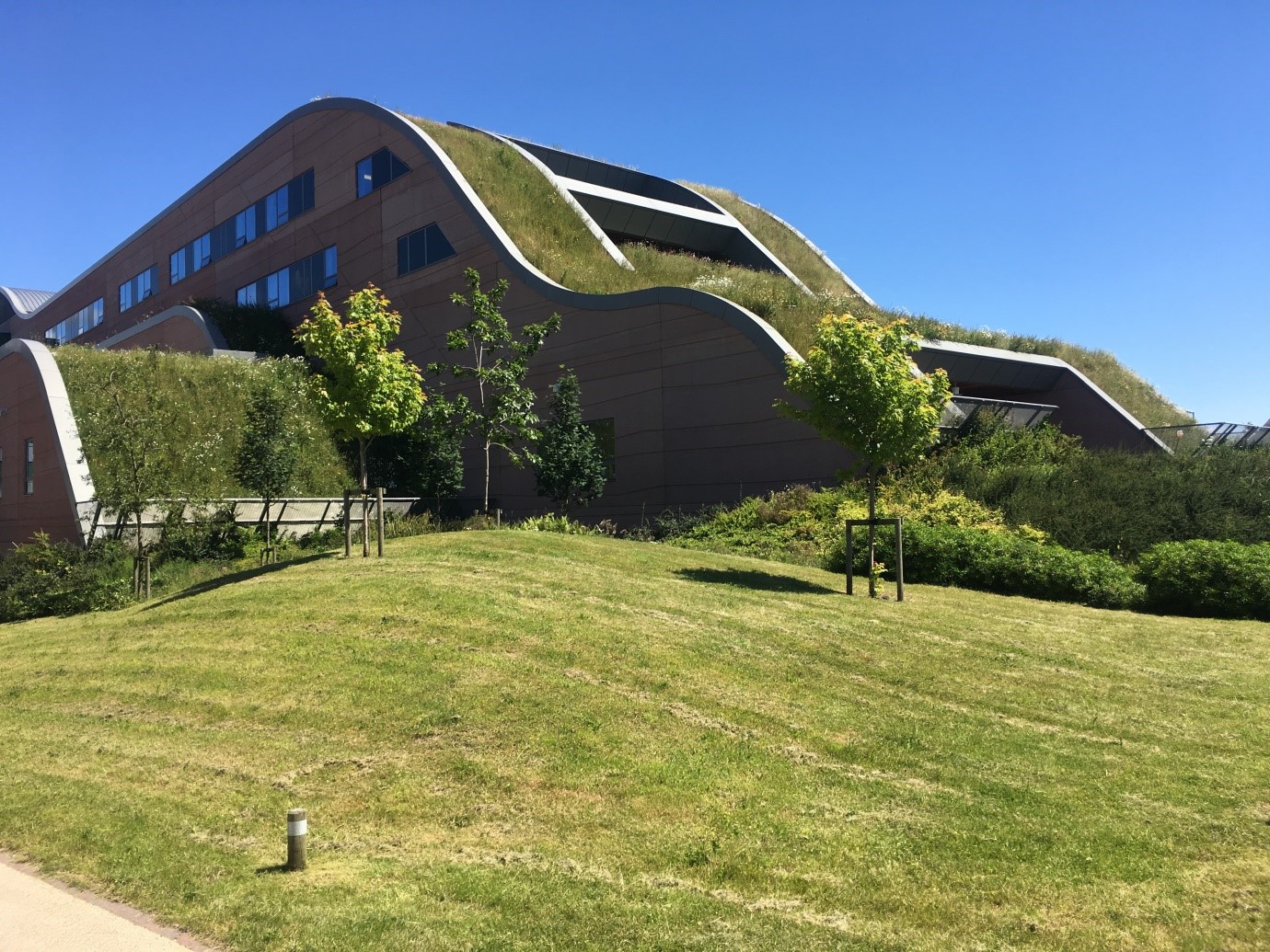

“The properties consist of high-quality garden-style assets with significant green space and resort-style amenities, built, on average, in 2000. The majority of the properties are located in Atlanta, Phoenix, Orlando, Denver and Austin,” Blackstone said.

The stock traded at $119.16, down 3.3% at last check. Morningstar analyst Greggory Warren puts fair value at $120.

“Blackstone has built a solid position in the alternative asset-management industry, utilizing its reputation, broad product portfolio, investment performance track record and cadre of dedicated professionals to not only raise massive amounts of capital but sustain the reputation it has built for itself as a 'go-to firm' for institutional and high-net-worth investors looking for exposure to alternative assets,” he wrote in October.

“That said, investors in Blackstone are betting that the company's outstanding investment track record and fundraising capabilities will continue into the future.

“While we have confidence in the firm's ability to earn excess returns over the next 10 years, we believe it will become increasingly difficult for the company to do so longer-term.”

Comments System WIDGET PACK

.jpg)