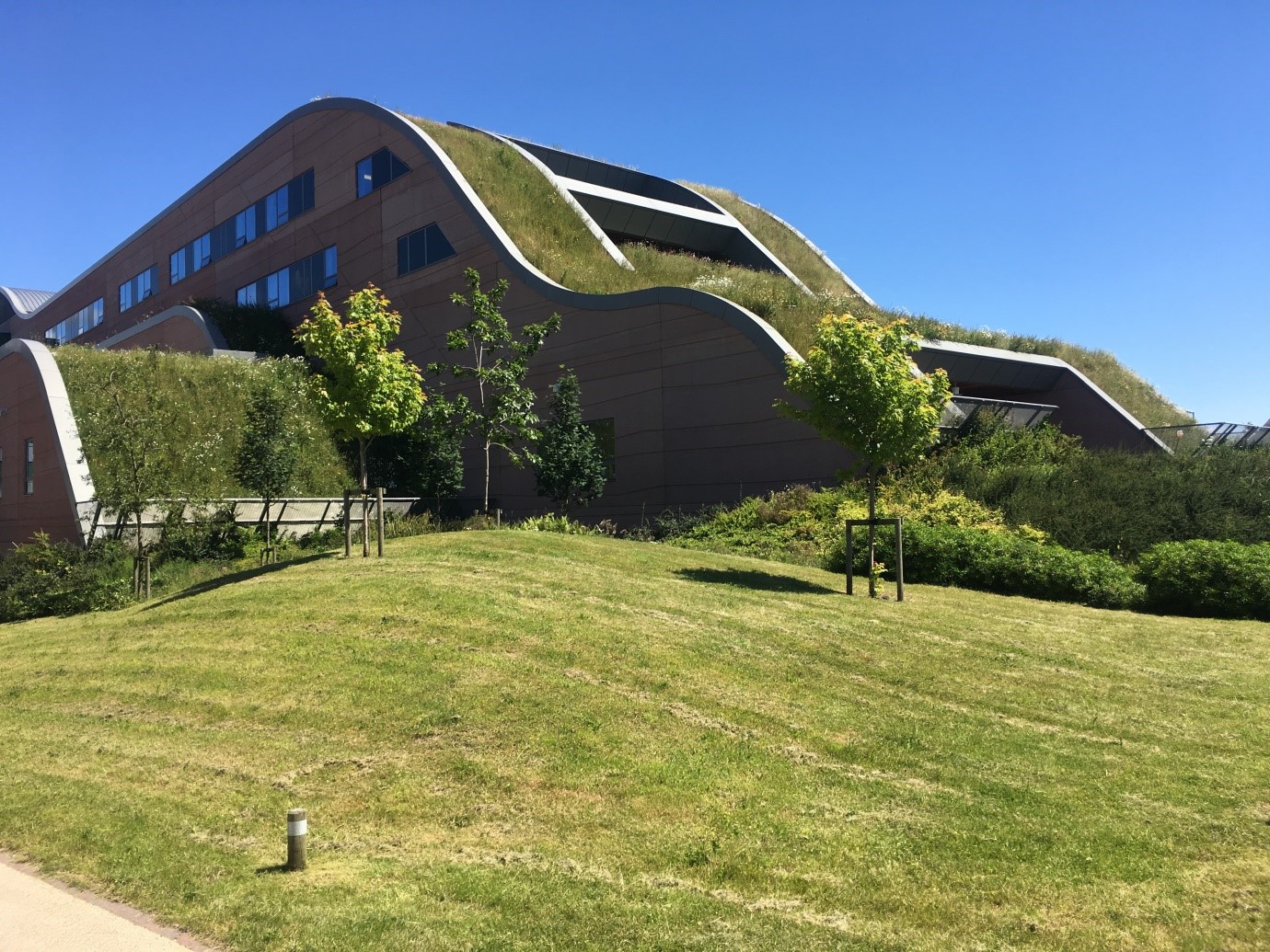

Three-quarters of aspiring homeowners say the pandemic and its property boom have damaged their chances of buying

Three-quarters of those wanting to get onto the property ladder in the next five years believe that the pandemic and its property boom has damaged their prospects of doing so, new research has revealed.

A total of 76 per cent of 2,000 potential first-time buyers surveyed said the Covid pandemic and the rapid rise in house prices seen during it has had an negative impact on their plans

The research by Latimer - the development arm of Clarion Housing Group - also suggested that a purchase or move had been delayed by at least three years for a fifth of potential buyers.

In addition, only 21 per cent of those aged between 18 and 24-years old believe that they will ever be able to afford a deposit without help from the Bank of Mum and Dad.

It is hardly surprising, therefore, that the same research found that 47 per cent say that the housing ladder is no longer accessible to young people.

The property market temporarily shut down for around two months at the start of the pandemic in 2020, leading to widespread predictions of house prices falling

Fast forward towards the end of 2021 and the past 12 months have seen a boom in property purchases, a stamp duty holiday that has now ended, and house prices soar amid a shortage of homes to buy.

Nationwide Building Society says the average house price has risen by around 10 per cent during the past year to £250,011.

.jpg)