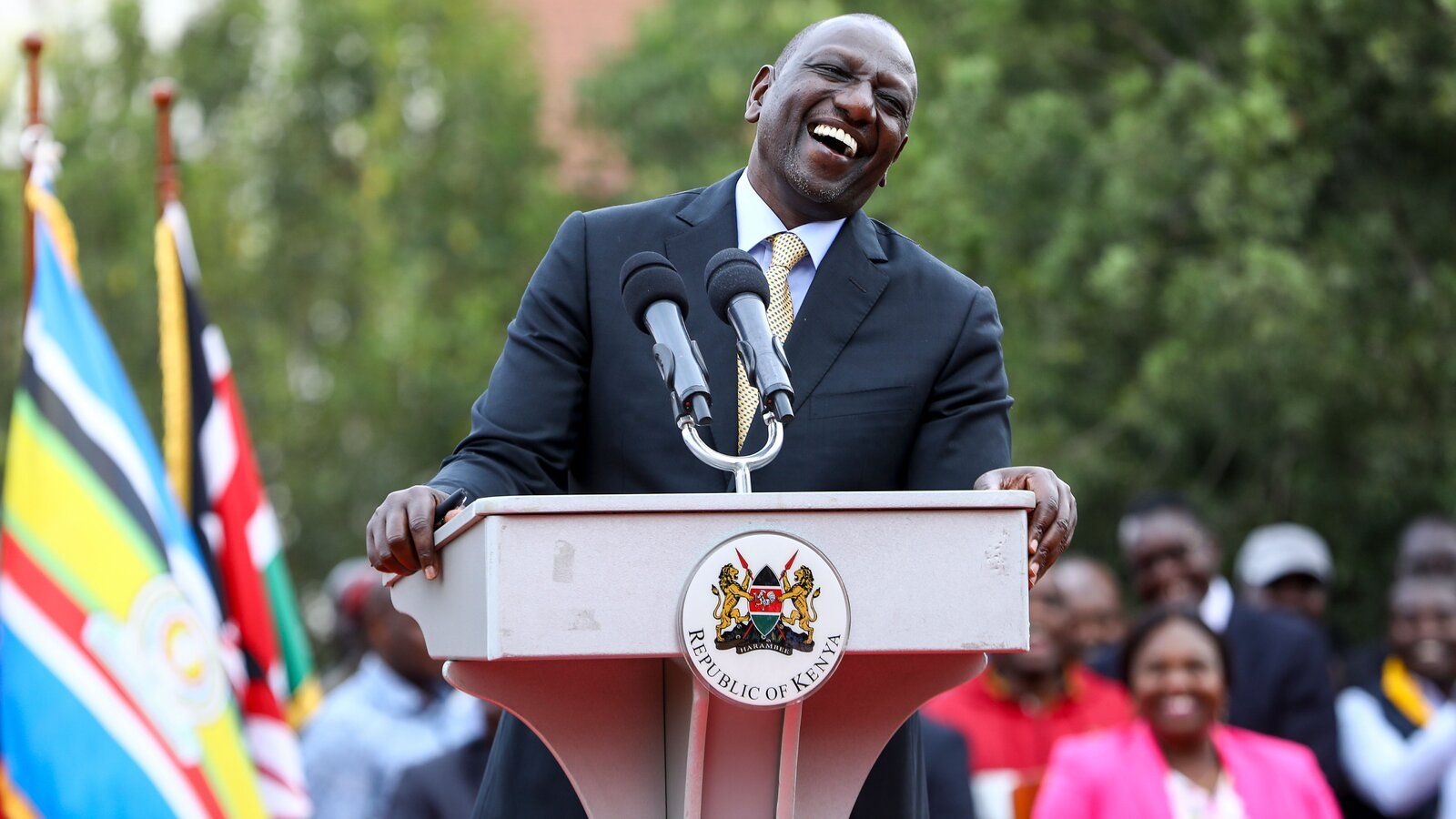

Continent – Wide Real Estate Investment Potentials Awaiting Serious Assert Managers in Africa

YOU CAN ACCES FOR FREE YOUR CURRENT EDITION OF OUR PE DIGITAL MAGAZINE - CLICK LINK BELOW

The African Continental Free Trade Area (AfCFTA) came into force on 1 January, 2021. Once it becomes fully implemented and operational by 2030, the AfCFTA could be the world’s biggest fully-realized free-trade zone by area. The bloc has a potential market of 1.3 billion people and a combined gross domestic product of $2.5 trillion. This moment should be celebrated as the AfCFTA could portend a new era of African openness, co-operation, trade, progress and innovation. The momentum of this new trade area thereof should be used to push African governments even further in the direction of free trade.

Whenever a nation restricts economic freedoms and civil liberties, humanity suffers. The ease with which people can trade (from the simplest good and service, to the most complicated) with both their immediate neighbors, and people from all over the globe, is a good indicator of a given government’s view of economic freedom.

When countries have more barriers to trade, including arbitrary regulations, widespread corruption, and myriad tariffs, we find a generally lower quality of life.

Over time, the AfCFTA will aim to eliminate import tariffs on 97 percent of the goods traded on the continent itself, while also reducing non-tariff barriers.

Tariffs serve to discourage not just the physical movement of goods across borders, but also act as a psychological barrier to the exchange of ideas. They also prevent the flow of crucial goods and services in the case of an emergency. In 2020 alone, tariffs and other levies made the movement of COVID-19-fighting equipment and medicines far slower and more expensive than it otherwise would have been. To grow, supply chains (of all types) require an environment of robust property rights, underpinned by the rule of law – the AfCFTA can encourage such an environment across the continent.

REGISTER TODAY FOR YOUR AFFORDABLE HOUSING ALLOCATION IN GHANA

According to the African Export-Import Bank, the AfCFTA could boost intra-African trade to 22 percent of total trade, up from 14.5 percent in 2019. If African countries are to step up the maturing of their industries and wider economies, they need more goods to flow – and the added expertise and insights of various businesspeople and manufacturers will also increase once it is easier for them to move between different countries.

According to Alexander C. R. Hammond, “when African states trade with one another, the goods traded are almost three times more likely to be higher-valued manufactured products, when compared to the goods that leave the continent.” At the time of writing, all but one of the 55 African Union nations have signed to join the area, and more than half have ratified the accord. Through implementing the AfCFTA swiftly and effectively, the continent could set itself apart as a prime destination for investment and innovation.

The Federal Executive Council ratified Nigeria's membership of the African Continental Free Trade Area (AfCFTA) on the 11th of November 2020. This occurs more than a year after Nigeria signed the African Continental Free Trade Agreement (the "Agreement") in July 2019. The Agreement establishes a single market for goods and services across 54 countries, allows for the free movement of business travelers and investments, and creates a unified customs union to streamline trade on the continent.

The AfCFTA Agreement comes into effect on the 1st of January 2021. Although, full implementation of the Agreement may take some time as countries would have to negotiate aspects of the Agreement such as trade, dispute settlement processes, tariffs and intellectual property rights.

Nigeria is however poised to gain from the investment and trade opportunities that the AfCFTA will inevitably bring. In this article, we highlight some of these benefits.

Nigeria has the largest economy and population in Africa with more than $500 billion in GDP and a population of 200 million. This market size allows manufacturers to increase capacity and expand into other African countries. This enables investors benefit not only from the Nigerian market but from other countries on the continent as well.

Diaspora Ghana Property Awards & Exhibition 2020-2021Investing in Ghana’s Green Building Economy

To put this in context, Nigeria contributes an estimated 76% of total trading volume in the ECOWAS region. This is made possible because of the ECOWAS treaty which provides for the free movement of people and goods throughout 15 West African countries. The AfCFTA grants access to 54 countries with a population of 1.2 billion and a market worth a combined $2.6 trillion in GDP.

Producers and retailers expanding their operations to other markets would depend on a distribution network that can efficiently deliver goods to their intended markets. This would give rise to increased investments in the distribution and logistics supply chain to ensure the infrastructure needed for transportation of goods is available. The winners would be investors who invest in the logistics and transportation space to cater for the large volume of goods which would be involved in cross-border trade.

The AfCFTA also seeks to create a single liberalized market for trade in services for the continent. Countries such as Nigeria which have an abundant supply of professionals in various services industries such as construction, engineering, technology, and financial services would see increased movement of such professionals to countries with a demand for their services. In addition, labor-intensive trade across borders would require the services of low skilled workers and the free movement of persons guaranteed by the AfCFTA will bring with it the free movement of services these persons will render.

The leaders of 44 African countries endorsed the African Continental Free Trade Agreement (AfCFTA). Since then more countries, including South Africa, have joined in. The agreement is expected to favour small and medium-size businesses, usually known by the acronym SMEs, which are responsible for more than 80% of Africa’s employment and 50% of its GDP.

Obviously, any economic policy that facilitates imports and exports among member countries - with lower or no tariffs, free access to the market and market information, and the elimination of trade barriers - offers numerous benefits to SMEs. And as history's largest free trade agreement, which has a market size in the region of $3 trillion, most people are excited at the development. But skeptics have pointed to impending challenges, especially those which affect SMEs. These must be addressed if the AfCFTA is to achieve its objectives. But first, let’s look at who stands to gain.

The AfCFTA will allow African-owned companies to enter new markets. This expands their customer base and leads to new products and services, making investing in innovation viable. Manufacturing represents only about 10% of total GDP in Africa, on average. This is well below the figure in other developing regions. A successful continental free trade area could reduce this gap. A bigger manufacturing sector will lead SMEs to create more well-paid jobs, especially for young people, thereby alleviating poverty.

With restrictions lifted on foreign investments, investors will flock to the continent. This adds capital to expand local industries and boost domestic businesses. New capital enhances an upward productivity cycle that stimulates the entire economy. An inflow of foreign capital can also stimulate banking systems, leading to more investment and consumer lending.

The AfCFTA will ease the process of importing raw materials from other African countries. It will also enable SMEs to set up assembly firms in other African countries, in order to access cheaper means of production and thereby increase their bottom lines.

Global companies have more expertise than domestic companies to develop local resources. That's especially true for businesses in the manufacturing sector. The AfCFTA will allow multinationals to partner with local firms to develop raw materials, training them in best practices and transferring technology in the process.

A major potential challenge in harmonizing Africa’s heterogeneous economies under one agreement is the wide variation that exists in their levels of development. For example, over 50% of Africa’s cumulative GDP is contributed by Egypt, Nigeria and South Africa, while Africa’s six sovereign island nations collectively contribute just 1%.

The AfCFTA has the greatest levels of income disparity of any continental free trade agreement, and more than double the levels witnessed in blocs such as ASEAN and CARICOM.

Many emerging African markets are traditional economies that rely on farming for employment. These small family farms can't compete with large agri-businesses in high-income African countries such as South Africa, Kenya, Ethiopia, Egypt and Nigeria. As a result, they may lose their farms, leading to high unemployment, crime and poverty.

Without comprehensive policy-making and preferential treatment for Africa’s most at-risk economies, the AfCFTA could prove to be a force for economic divergence, rather than a force for good. It is therefore important that participating countries build an efficient and participatory institutional architecture to avoid leaving any economies behind.

To increase the impact of the trade deal, industrial policies must also be put in place, especially those concerning SMEs and manufacturing. These must focus on productivity, competition, diversification and economic complexity.

Furthermore, individual countries under the agreement should introduce policies that address the concerns of labour unions, encourage healthy competition without killing local businesses, ensure strict adherence to waste disposal and protect intellectual property.

This article is produced by PE Magazine. Written by Henry Ameyaw Phd. Business and Commercial Correspondent of PE Magazine

Source : PE Magazine

Comments System WIDGET PACK

.jpg)