High demand from tenants for zero deposit schemes, research reveals

More than half of tenants in the private rented sector in the UK are interested in alternative or insurance backed schemes as a substitute for paying an upfront lump sum deposit when renting, new research has found.

Some 70% of tenants say that having the choice to pay an upfront deposit scheme would influence their decision whether to rent a specific property, according to a survey from letting agent Your Move which was commissioned to find out about the behaviours and attitudes of tenants.

The survey comes as new requirements come into forces. From today (01 April) the Government has made it obligatory that all property agents will be part of an approved Client Money Protection Scheme (CMPS).

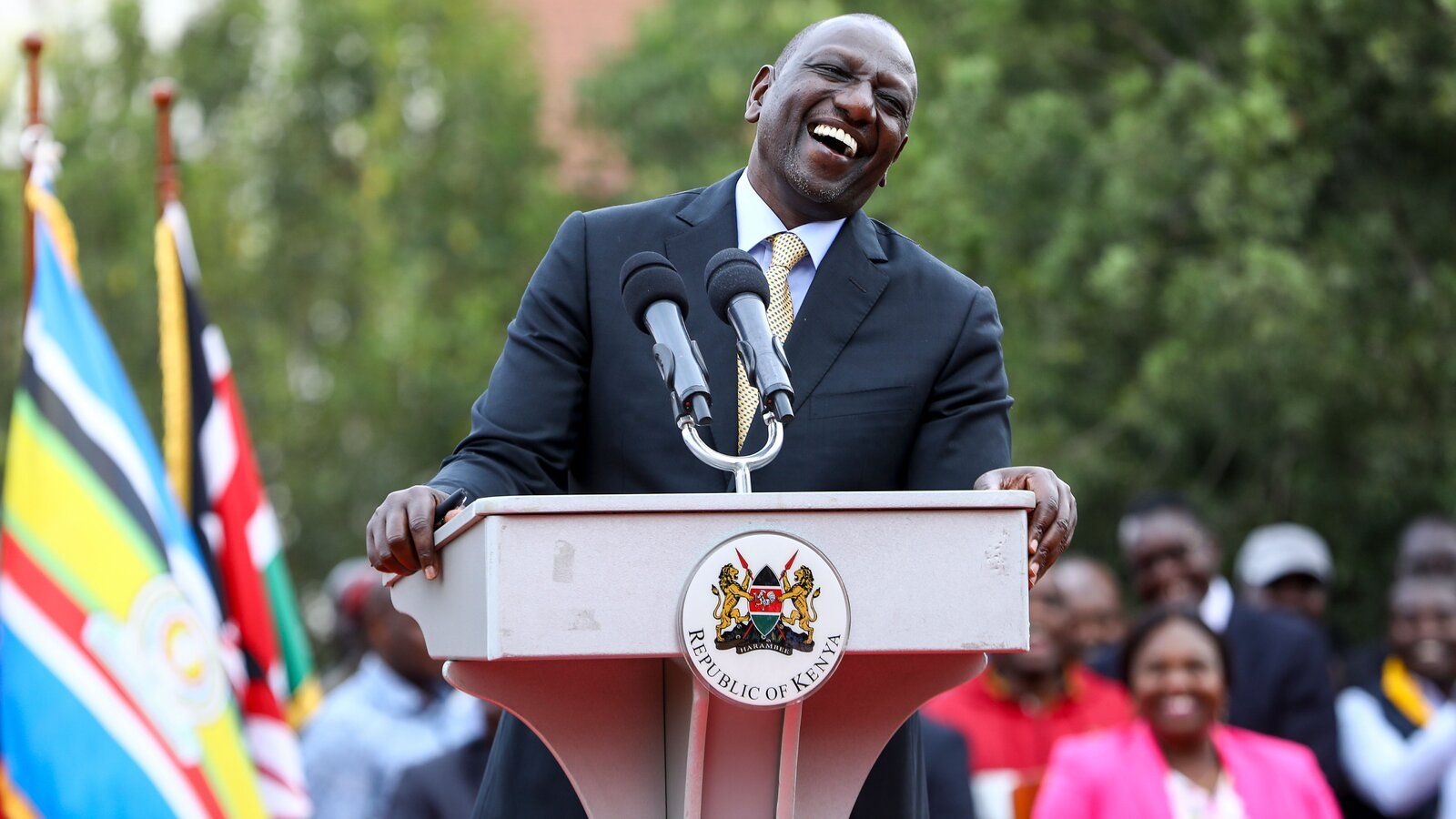

David Cox, chief executive of the Association of Residential Letting Agents (ARLA) said agents who have not joined an approved CMP scheme will be operating illegally and risk facing large fines.ARLA has received formal approval from the Housing Minister Heather Wheeler to operate a Government authorised CMP scheme on behalf of its members, so they are all automatically covered. ‘Those who aren’t part of a professional body can sign up to Money Shield, a straight forward and cost effective solution with formal Approval,’ Cox pointed out.

Over half of the 3,752 adults surveyed said that they would be interested in an alternative approach to tenancy deposits which includes zero deposit schemes where the tenant may pay a non-refundable fee of one week’s rent to move in, rather than an upfront deposit.

The study report explains that the fee acts as an insurance guarantee for the landlord that, should the tenant be responsible for any loss or damage, the scheme will pay the landlord compensation for this and recover the costs from the tenant directly.

KINDLY FOLLOW THE PROCESS TO RESERVE OR BUY AN ADVERT PAGE

We are pleased to have you here.

You can easily buy your advert page in any of our magazine by clicking on here to follow the process to reserve an ad page in our magazines.

YOU CAN PAY ON-LINE OR RESERVE A PAGE

Of those surveyed, either budgeting families, defined as those aged between 25 and 44 years with children at home, or reconciled with renting, defined as aged 45 and above and who are most likely to be renting due to a change in personal circumstances, more than half were interested in alternative deposit schemes.

In addition, of all those surveyed, some 70% would be influenced by the choice of such schemes when deciding whether to rent a specific property.

‘There is clearly demand for an alternative to cash lump sum deposits. With more and more people now choosing to rent, it’s increasingly important that lettings agents are able to cater to tenants of all types, providing them with both choice and flexibility,’ said Helen Buck, executive director for Estate Agency for Your Move’s parent company, LSL Property Services.

‘At Your Move we’ve already made a zero deposit scheme available to offer even greater choice to our landlords and tenants and ultimately allow them to realise their ambitions within the rental market,’ she added.

Propertwire

Comments System WIDGET PACK

.jpg)