HOUSING AND AFRICA'S GROWTH

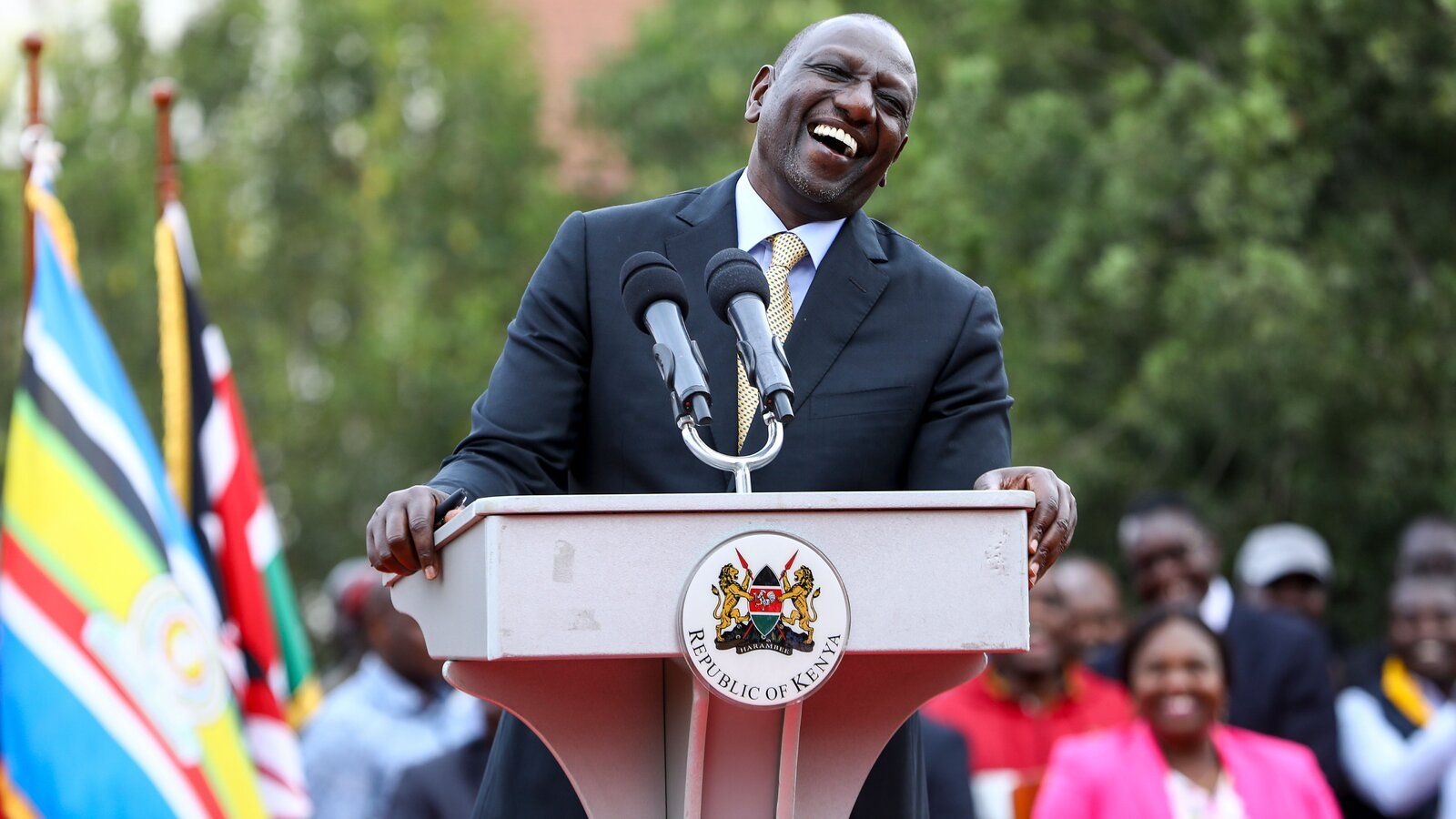

The 32nd Annual Conference of the African Union for Housing Finance offers stakeholders a platform for discussing and sharing experiences, and deliberating towards innovative interventions to support the growth of Africa’s economies through the development of a vibrant housing sector. Offered by an industry body with an explicit mandate to support the growth of Africa’s housing finance sector, the conference will realise actionable recommendations that will transform the housing landscape and create new opportunities across the continent.

Affordable housing delivery to meet an ever increasing demand presents a tremendous investment opportunity that can substantially impact on Africa’s growth agenda.

In Nigeria alone, a backlog of an estimated 17 million units suggests that housing construction will be at the forefront of that country’s economy for some time. Already, Nigeria’s real estate sector is one of the main, non-oil sector contributors to the country’s rebased GDP, contributing 11 percent by 2014. Given the projected demand, it is estimated that the N6.5 trillion market will grow at an average of ten percent over the next few years. Of course, affordability remains a key constraint, combined with a host of other issues concerning land, cost of funds and the overall enabling environment. Despite these, the opportunities for significant returns on housing investment, while also meeting a fundamental social need, are tremendous. At Nigeria’s current mortgage rates, a simple $20,000 house could be affordable to about 16% of the urban population, or about 3 million urban households.

Bring the house price down to $15,000 and an estimated 35% of Nigeria’s urban population could afford to buy housing with a mortgage – this is in the region of 6.6 million households, and could create $99 trillion in investment and upwards of 4 million jobs. What are the opportunities and how might these be captured to support Africa’s growth agenda going forward? This is the focus of this year’s annual conference of the African Union for Housing Finance.

Taking place in Abuja, Nigeria, from 14-16 September, the conference is structured around key themes ranging from the potential of public-private partnerships to unlocking hidden potentials, to the challenges of funding the mortgage portfolio, the opportunities to be found in rental housing and housing microfinance, and the strategies to address the challenge of affordability. With an agenda structured around presentations in plenary and panel discussions, as well as a housing marketplace to support focused conversations between investors and projects, the conference will attract stakeholders from across the continent, all with the express purpose of furthering investment in affordable housing.

2nd Nigerian edition of the Housing Microfinance Academy

We also want to invite you to join the second Nigerian edition of the Housing Microfinance Academy which will form part of the conference – the details are below and you can indicate your attendance when you register for the conference.

The Housing Microfinance (HMF) Academy is a series of events organized by LafargeHolcim to enhance the HMF availability for low/middle-income people around the globe. So far, over 100 financial institutions on 4 continents have joined the Academy. It participates in LafargeHolcim’s ambition to make affordable housing accessible through innovative solutions.

Lafarge Africa Plc – a member of LafargeHolcim – pioneered this revolution by implementing the ‘Easy Home’ HMF scheme, enabling 20,000 Nigerians to move into their homes in 3 years.

A first Nigerian HMF Academy was organized in October 2015. Following its success, a working committee was created, with the following objective: ‘Create conditions for scaling up and improving HMF for individual home builders and designing a product (financial and technical) enabling HMF institutions to access capital markets.’

The 2016 edition will provide presentations of the working committee’s conclusions, and create opportunities for knowledge sharing & definition of solutions. It promises to turn reflection into actions.

Any institution envisaging HMF solutions should participate:

• Microfinance Banks

• Commercial / Mortgage Banks

• DFIs

• Affordable / Social Housing Developers

• Government

• NGOs

Benefits:

• Access to a network of HMF practitioners

• Knowledge sharing on HMF

• Build Micro Mass Housing Solutions

• Access to funds

Participation is free but you must indicate your participation when you register for the conference.

Comments System WIDGET PACK

.jpg)